The arrival of dApps has forced the Ethereum network to face an exponential growth in volume and throughput. But what if there was another blockchain that could leverage the Ethereum’s technology while also offering higher throughput, with extremely low transaction fees, and better options for building dApps? This brings us to our primary concern about scalability, which the Polygon network is here to fix.

What is Polygon Technology?

At its core, Polygon is a Layer 2 scaling platform. This means that it is built on top of the Ethereum blockchain and relies on it for its underlying infrastructure. However, Polygon goes beyond this concept. It also provides a full-fledged suite of tools and services that make it easy for developers to create and connect their own blockchain networks, or “sidechains,” to the Ethereum blockchain.

Everything is because Main blockchains (layer 1) are too slow to handle the volume of transactions people want to make.

The ways to address this problem are two: either the blockchains become less secure and safe but faster, or we find a secondary method to speed them up with no security issues. Layer 2 blockchain technology is one of the best ways to address the scaling issue of the Ethereum network.

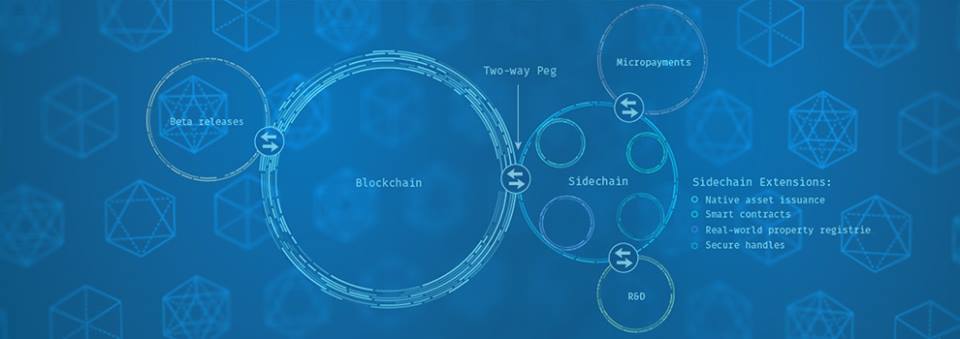

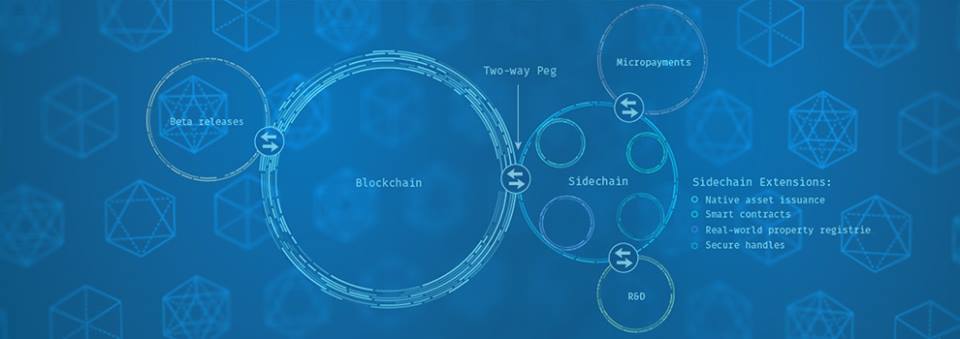

Also, when it comes to scaling, there are two main methods of doing it: layer 2 scaling and side chains. Layer 2 scaling relies on the security of the main layer, the Ethereum blockchain. The most popular options for layer 2 scaling are plasma optimistic roll-ups and zk roll-ups.

Initially, all scaling solutions such as side chains, plasma, and roll-ups were classified as layer 2 solutions, as they are built on top of layer 1. However, the Ethereum community started differentiating between scaling solutions fully secured by the Ethereum main chain (layer 2) and other scaling options with their own consensus mechanisms (side chains).

But, Instead of providing one or two scaling solutions, Polygon aims at creating an ecosystem that makes it easy to connect multiple different scaling solutions. This includes everything from side chains with different consensus mechanisms to layer two options.

The founders and creators behind Polygon’s Company

The Matic Network project started in 2016 by three founders who were active participants in the cryptocurrency community in India. Jaynti Kanani, Anurag Arjun and Sandeep Nailwal and their team made up of experienced blockchain developers, security experts, and financial industry professionals set out to find a solution to Ethereum’s scalability issues.

They decided to work together and tackle Ethereum’s scaling problems. The team focused on two main solutions – plasma chains and layer 2 scaling solution based on Matic’s implementation of plasma and a proof-of-stake Ethereum side chain.

Their efforts led to the creation of Matic, which was its name back then. They led the company with the goal of increasing the use of DeFi tools and applications by connecting blockchains together.

The token behind Matic Network, $Matic, was distributed through the finance launchpad’s Initial Exchange Offering (IEO) in April 2019 and the team was able to raise 5.6 million dollars. After over two and a half years of hard work, the Matic Network mainnet went live in mid-2020.

In March 2021, Matic underwent a rebranding and became Polygon, reflecting its expanded focus on providing a decentralized infrastructure for scalable and secure blockchain applications. The rebranding also better conveyed the platform’s modular design, which enables the development of a wide range of decentralized applications.

With a shared vision of creating a decentralized world, the team has been working tirelessly to build a platform that supports the growth of the decentralized ecosystem. The founders, Jaynti, Anurag, and Sandeep, bring a wealth of experience and expertise to the project, and their leadership has been instrumental in its growth and success.

Now let’s explore how it accomplishes this.

The Science and Work of the Polygon Technology

In short, the Polygon commit chain groups up bunches of transactions and processes them before sending the data back to the main Ethereum chain, acting, indeed, as a layer 2. Polygon just takes a single snapshot occasionally so that the Ethereum chain can still understand what’s going on, but without having to process a lot of data. This is why the Polygon network can actually up to 65000 transactions per second.

The Polygon platform allows users to create their own blockchain networks, known as child chains, which are connected to the main Polygon chain. These child chains can change to fit the needs of specific applications and can connect with other child chains as well to the main chain thanks to the magic of bridges.

In a more technical manner. Polygon supports two major types of Ethereum compatible blockchain networks: standalone networks and secured chains networks. Standalone chains rely on their own security, such as having their own consensus models like proof of stake or delegated proof of stake.

These networks are fully sovereign, offering the highest level of independence and flexibility, but it becomes more difficult to establish a reliable security model. For example, proof of stake requires a high number of reliable validators, making it more suitable for enterprise blockchains and established projects with strong communities.

Secured chains, on the other hand, utilize the security as a service model. This can be provided directly by Ethereum, such as through fraud proofs used by plasma, or by a pool of professional validators. These validators running in the Polygon ecosystem can share within multiple projects, similar to Polkadot’s shared security model. Secured chains offer the highest level of security, but sacrifice independence and flexibility.

The Polygon Blockchain architecture

Getting way more technical, Polygon’s architecture runs on a four abstract and composable layer system, which are: the Ethereum Layer, the Security Layer, the Polygon networks Layer, and finally the Execution Layer.

The Ethereum Layer of Polygon is made up of different Ethereum-based smart contracts. These contracts are responsible for staking, transaction approval, and interaction between the Ethereum blockchain and numerous Polygon chains. This layer is non-mandatory and allows Polygon to check in with Ethereum from time to time. This layer can also be used as the base layer and will leverage Ethereum’s high security if available.

Next, we have the Security Layer. It works alongside Ethereum to provide validator services and give chains an additional layer of security. However, it’s important to note that both the security layer and the Ethereum Layer, as mentioned before, are actually optional and not required for Polygon network to work.

The Polygon Networks Layer is the ecosystem of projects or blockchain networks developed on Polygon itself. Each project or blockchain within this ecosystem has its own community where local consensus is reached and blocks are produced. It consists of sovereign blockchain networks where each network can maintain functions such as transaction collation, local consensus and block production.

Finally, we have the Execution Layer which is the one responsible for interpreting and executing transactions included in the Polygon chains. It consists of the Execution Environment and Execution Logic sub-layers. Also known as the Polygon Ethereum Virtual Machine.

What’s so special about Matic’s Blockchain?

Well, as it turns out, it quite an achievement what they have accomplished. Because the Polygon blockchain platform addresses many of the scalability and security issues commonly associated with decentralized applications.

Here are the most common reasons for migrating to the polygon network:

- Scalability: The Polygon platform allows users to create their own scalable blockchain networks, enabling them to build and deploy dApps that can handle high volumes of transactions. While Ethereum can handle 15 to 30 transactions per second, Polygon can handle around 65,000 transactions per second.

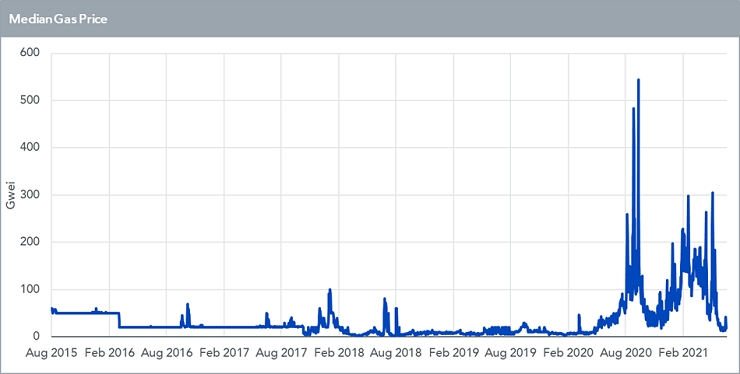

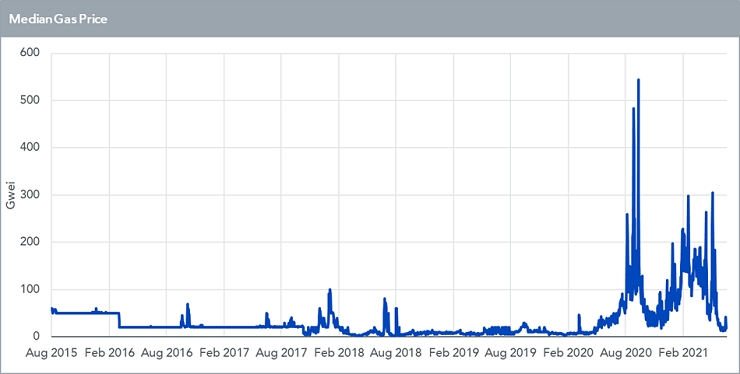

- Low transaction fees: The Polygon network uses a system of transaction “gas” that is recycled within the network, reducing the need for users to pay for gas with tokens. For example, in the ETH network you can expect something around 20 dollars, but within the polygon network it worth less than a penny. This makes it an affordable platform for users and developers.

- Flexibility: The Polygon platform offers a modular design, allowing users to customize and add features to their networks. This makes it a versatile platform used for a wide range of applications. From finance and gaming to supply chain management and voting systems.

- Fast transaction speeds: The Polygon platform uses layer 2 technologies such as optimistic or zkRollup chains to handle transactions off the main Ethereum blockchain (Hermez, Nightfall, Miden and Zero), resulting in fast transaction speeds.

This all makes it an important platform for the development and adoption of decentralized technologies. A super-friendly one at least, bringing all the benefits of the Ethereum blockchain within a secure environment.

Polygon vs. Ethereum Network

Teams like Polygon acknowledge the limitations of the Ethereum network but still believe that it is the core chain they want to build for. To overcome the limitations, they aim to make transactions faster, lower the cost and increase the speed.

Since its inception, Ethereum has introduced many innovations to the cryptocurrency world, such as smart contracts and high-interest paying decentralized applications. But even from it’s start it faced three major obstacles that have been overcome by other projects such as Polygon. The low throughput issue is the first one. What this means is the Ethereum blockchain can only process a limited number of transactions (in fact, it can only handle 30 transactions per second).

Considering the amount of people who are actually using Ethereum, this processing speed is quite low and could lead to congestion and slow transaction speeds. This has a direct impact on its scalability.

Another thing to consider about the Ethereum network is that it is not very user-friendly. Since you are competing against everyone else who wants to be one of the 30 tps. In short, it becomes an expensive network. And If you used the Ethereum network before, probably know what we mean by that. Furthermore, all Ethereum projects run on the same network and have a similar throughput, which implies that they all share the Ethereum issue, without exceptions.

It is a fact that these protocols don’t look to replace layer 1 blockchains but work alongside them.

The Advantages of using Polygon over Ethereum layer 1?

The fees are a matter of supply and demand, which depends on the amount of space and throughput available on the chain and the number of people trying to use it.

Polygon and Solana shine when markets are up as there is a huge amount of excitement and everybody wants to make transactions all at once. At that point, Ethereum cannot handle the load, causing fee spikes.

The Polygon blockchain processes transactions in batches and then sends them over to Ethereum, taking all the workload off the Ethereum network.

In the cryptosphere the concept of an Ethereum Virtual Machine is seen as the actual code that is run by computers around the world to carry out the blockchain’s smart contracts.

Anyway, Polygon actually has an Ethereum Virtual Machine, but so do several other big networks, including the BNB Chain. They all rely on the main Ethereum network code. Since they run the same code, it makes sense that a developer could simply move their project to a new network, which would work the same way without requiring many changes.

Strategic Partnership and integration to Polygon Blockchain

Many creators that develop useful tools will actually move them from Ethereum to other EVM blockchains, like Polygon, in order to increase their reach and usage.

Some of the projects that have already migrated to the Matic POS chain, launched directly on Matic, or are in the process of migrating includes Quick Swap (a fork of Uni Swap), Sushi Swap, Avegotchi, Polka Markets, and the list goes on.

Besides that, infrastructure projects such as the graph and chain link have also decided to expand to polygon. Not to mention the big announcement polygon’s team made with a big player in the video gaming industry: Atari.

So far, it looks like Matic’s rebranding to polygon and the expansion of the scope of the project was a really good idea.

Use cases for polygon’s platform

Polygon provides multiple options for the teams behind different applications to choose the one that perfectly fits their use cases. It aims at making it easy to migrate from one scaling solution to another one, which might be necessary if the circumstances behind the project change or if a better scaling solution becomes available.

The polygon’s architecture also allows for multiple different Polygon-based scaling solutions to communicate with each other, preventing siloed systems.

Secured chains offer the highest level of security, but sacrifice independence and flexibility.

This approach, often favored by startups and projects that prioritize security, aims to provide a flexible and scalable solution.

DeFi protocol that aims to store billions of dollars locked in smart contracts may prioritize security and be okay with sacrificing sovereignty. In this case, it would most likely use the Ethereum layer.

On the other hand, an NFT marketplace may want to optimize for ultra-low transaction costs and be okay with lowering their security. In this case, they could skip the Ethereum layer and rely on the security layer with a set of shared validators.

Finally, a blockchain-based game may want to rely on its own consensus mechanism with ultra-fast block time. In this case, it could entirely skip both the Ethereum and the Security layer and focus on the Polygon Network layer.

At the moment, the only scaling solutions available in the Polygon ecosystem are the Matic POS Chain and the Matic Plasma Chain solutions. The team is actively working on adding multiple other options such as DK Roll-Ups, Optimistic Roll-Ups, enterprise chains, and other side chains.

Understanding Polygon’s Proof-of-Stake Model

The Polygon blockchain platform uses a proof-of-stake (PoS) consensus mechanism, which allows users to validate transactions and earn rewards by staking their tokens.

Moving on, when we think about Polygon, most people think about the Polygon proof of stake chain which is simply a side chain to Ethereum, utilizing a proof of stake consensus mechanism.

Matic tokens are technically printed to reward stakers, making it inflationary in theory. However, Matic does have a limited supply and after the implementation of their version of an EIP1559 this has changed.

This has basically caused the base transaction fees to be burned, which has effectively made Matic a deflationary token. The transition to a deflationary model is a significant change from the previously inflationary supply through staker rewards.

The adoption of EIP1559 brings several benefits to the Matic network. First, it helps to reduce the overall token supply and ensure that the token remains valuable over time. Additionally, the deflationary model aligns the incentives of all network participants towards the overall success of the network.

Consensus Mechanism of Polygon Blockchain

Any side chains using a consensus mechanism that limits the number of entities can verify the chain. For example, in a Delegated Proof of Stake, there are usually 21 validators chosen by the token holders and only these validators are able to validate the state of the blockchain.

Similarly, in a Proof of Authority model, the chain initiator chooses authorities to run the chain, excluding most participants and creating a situation where only a selected few are responsible for making sure the transactions are validated correctly.

In Polygon Commit Chain, anyone can join the network and start validating the state of the blockchain. This is important as it allows any participant to become a validator and check by themselves that all transactions are processed correctly.

Validators on Polygon POS chain have to stake Matic tokens, and run a full node. Matic tokens are staked on the Ethereum main chain, which is also where the set of all validators is maintained.

Now, you might be wondering how they will reward the stakers when the funds run out. The Polygon team hopes that by then, the extra transaction fees that users add to prioritize their transactions above the base fee will be enough to incentivize staking validators to keep doing their thing.

The Matic chain scaling solution

Polygon provides multiple options for the teams behind different applications to choose the one that perfectly fits their use cases. It aims at making it easy to migrate from one scaling solution to another one, which might be necessary if the circumstances behind the project change or if a better scaling solution becomes available.

At the moment, the only scaling solutions available in the Polygon blockchain ecosystem are the Matic POS Chain and the Matic Plasma Chain solutions. The team is actively working on adding multiple other options such as DK Roll-Ups, Optimistic Roll-Ups, enterprise chains, and other side chains.

In short (if possible) The Matic Plasma chains is an Ethereum layer 2 predicate-based plasma implementation. Here wen we talk about Plasma we reffer to a framework for building scalable decentralized applications, allowing for offloading transactions from the main chain into child chains, enabling fast and cheap transactions.

One of the drawbacks of plasma is a long waiting period for users who want to withdraw their funds, and layer 2 plasma cannot be used to scale general purpose smart contracts.

The Matic POS chain is a permissionless sidechain that runs parallel to the Ethereum chain. Secured by a proof of stake consensus mechanism, with its own validators. Although it has its own consensus mechanism, the Matic POS chain also relies on Ethereum security when it comes to validator staking and checkpoints.

Is Polygon token a Safe Investment Opportunity?

When it comes to staking, the system is designed to be secure. If a validator starts to act maliciously, for example, by double-signing or having prolonged downtime, their stake will be penalized. This helps to maintain the security and integrity of the network.

So yes, security is a top priority in the world of cryptocurrencies, and the team strives to ensure the highest level of protection against any potential threats.

Anyway, it will be interesting to track polygon’s progress when it comes to adding more scaling options and onboarding more and more projects. We’ll also have to see how easy it will be to communicate between different scaling solutions with different security guarantees.

Breach and The 2 million MATIC exploit

In December 2021, they announced on an article post that a massive bug had been found on the polygon’s Proof of Stake chain. According to Cointelegraph, this bug posed a risk of 24 billion dollars to Matic, which happens to be almost the entire fully diluted market cap at the time.

Unfortunately, a hacker was able to exploit their bug, found a flaw in the code before the team noticed and patched it and get away with over two million dollars worth of Matic Tokens. The polygon team explained that they kept the hack in secret at first because drawing attention to it could have resulted in other hackers joining in.

MATIC vs Polygon: are the same thing?

It was never the same thing. The Matic token symbolizes the company’s financial standing, similar to a virtual share in stocks. For this, the company rebranded to The Polygon blockchain which has a native token called Matic.

This token, which bears the company’s previous name, remained the same, as it should. Bassically the separation of the cryptocurrency and project name was a deliberate effort to distinguish them.

An Introduction to the MATIC Token: What You Need to Know

Now, let’s get into the Polygon Tokenomics.

The Polygon network has a native token called Matic, which has been trading for around 2 dollars in its all time highs with a market capitalization value of around 13 billion dollars. Matic tokens are dispersed monthly and have a total supply of 10 billion tokens, of which nearly 6.8 billion is already in circulation.

The difference between these two numbers is due to tokens being held for staking rewards and tokens with a time-locked release schedule.

Initially, the developers sold around 3.8% of Matic’s total supply in their initial private launch all the way back in 2017. They then had an initial exchange offering where they sold another 19% of their max supply.

If you’re wondering where the other tokens are, let me give you a breakdown. The development teams own 16% of the supply, while the advisors have 4%. Staking rewards come to around 12%. The ecosystem already has 23% and around 22% went to the Polygon Foundation.

What is MATIC’s crypto current price?

Matic’s early February 2023 price is around $1, but as with every other cryptocurrency, it is always changing. If you want to check the accurate price you can see Matic’s chart on trading view or visit coingecko.

What is the Polygon MATIC token used for?

Polygon and Ethereum enjoy a close integration, allowing developers to build decentralized applications on the Polygon network while utilizing Ether. Although, Polygon’s growth is heavily tied to Ethereum. Chain analytics reveal a considerable user base that exclusively uses Polygon and doesn’t require Ethereum.

Side chains provide a mechanism for users to transfer their tokens from the main blockchain to a separate, parallel chain, where they are able to use within that ecosystem. The transfer of tokens is facilitated through a two-way peg or bridge, allowing for seamless movement between the main chain and side chain.

It’s important to keep in mind that once tokens are on the side chain, their security and integrity are dependent on the consensus mechanism of that side chain.

Polygon’s (MATIC) Crypto: Where to Buy and Sell it Safely

Polygon crypto token has been making waves in the cryptocurrency world and its cryptocurrency, Matic, is quickly gaining popularity. If you’re looking to get your hands on Matic, you’ll be pleased to know that there are several options available to you.

Cryptocurrency exchanges such as KuCoin or Binance are one of the most popular options for buying Matic. To buy on an exchange, you’ll need to set up an account, deposit funds, and place an order to purchase the token. The process is simple and straightforward, making it a convenient option for many.

If your preferred exchange doesn’t offer Matic, you can opt for a peer-to-peer platform like Binance P2P or Paxful. On these platforms, you can purchase Polygon crypto coin directly from other users, giving you access to the cryptocurrency even if it’s not available on your preferred exchange.

Regardless of the route you choose, you should consider factors such as security, fees, and user reviews before making a purchase to ensure you are making the best decision for your needs.

Just remember to compare your options, and make an informed decision that best suits you youre wishes.

Choosing the Right Polygon Blockchain Wallet: An Overview of Types

A Polygon wallet is a must-have for anyone looking to buy, hold, or trade the Polygon (MATIC) cryptocurrency. There are several types of Polygon wallets to choose from, each with its own unique features and benefits.

Software wallets, such as Trust Wallet. This are digital wallets that you can download and install on your computer or mobile device. These wallets provide a high level of security and control over your private keys, making them a popular choice for long-term storage of MATIC tokens.

But therse are not the only ones in the market, Hardware wallets, such as Ledger or Trezor, are physical devices that store your private keys offline.

Web wallets, such as Brave Wallet or Metamask, are online wallets that you can access through your web browser.

Regardless of the type of wallet you choose, it’s important to conduct thorough research and consider factors such as security, ease of use, and user reviews before making a decision.

The fastes Guide to Owning a Polygon Wallet Address

Acquiring a Polygon wallet address is a simple process that typically involves downloading and setting up a Polygon blockchain wallet. Here are the steps you should follow to start:

- Choose a Polygon wallet: Choose a Polygon wallet that meets your needs, such as a software wallet like the ones we mentioned above.

- Download and install the wallet: If you have chosen a software wallet, download the wallet application to your computer or mobile device and install it. For hardware wallets, follow the manufacturer’s instructions to set it up.

- Create a new wallet: Open the wallet application and create a new wallet. Make sure to follow the instructions carefully and securely store your private keys.

- Receive your Polygon wallet address: Once you have set up your wallet, you will be given a unique Polygon wallet address that you can use to receive Polygon tokens. This address is a string of characters that starts with ‘0x’ and is typically a combination of letters and numbers.

- Store your wallet address: Store your Polygon wallet address in a safe and secure place, such as a password manager or written down in a secure location. This will allow you to easily send and receive Polygon tokens in the future.

That’s it! You now have a Polygon wallet address and are ready to start buying, holding, or trading Polygon tokens. Remember to always keep your private keys safe and secure, and never share them with anyone.

Is Now a Good Time to Invest in Polygon Token (MATIC)?

Polygon has experienced significant growth over the past few years, with a growing number of Ethereum users choosing to use the network and Polygon becoming less reliant on Ethereum. The Matic network has over 25,000 dApps running on it, and it also has its own cryptocurrency, the Matic token.

However, the growth in macroeconomic pressures, fears of a recession, and slowing trading volume in crypto has led to a broad selloff across digital assets, including Polygon.

The Matic token fell around 80 percent in the first half of 2022. But due to recent developments in the cryptocurrency market, such as the recovery from the bear market, have led to a resurgence in the value of almost all digital assets, including Polygons.

Along those lines, the Matic crypto has regained much of its value and is once again performing well this first half of 2023, with technical analysis indicating a strong bounce at key Fibonacci levels.

As with any investment, the decision to invest should be based on an individual’s financial goals, risk tolerance, and research into the current market conditions and future potential of the network.

How High Will Polygon Crypto Go?

In a bull market, prices can rapidly increase, but there is also a tendency for sudden drops, making it challenging to predict key levels with certainty. So if you’re asking for a Matic price prediction, the short answer is: nobody knows.

Technical analysis and Fibonacci levels can provide some guidance, but the cryptocurrency market is highly unpredictable and influenced by factors such as market sentiment, news, and macroeconomic conditions.

Predicting key levels in the cryptocurrency market requires a careful analysis and thorough understanding of market conditions.

And all depends on the influence of hobby-manipulators like Elon Musk or unsettling news like that from FTX. This is why it’s crucial to always stay informed and keep an eye on market conditions.

The Rise of Polygon Blockchain – A Look into its Future

At this point It’s crystal clear that Polygon is a decentralized platform that aims to solve some of the key challenges facing blockchain technology.

By providing a platform for the development and deployment of scalable and secure blockchain networks, it opens up the possibilities for everyone to create and use dApps with confidence.

With over 3000 dApps already hosted on the network, including over 80 major names that have migrated from Ethereum, Polygon’s growth shows no signs of slowing down.

At the end, the network’s goal is not to replace Ethereum, but to become multi-chain and more closely resemble projects like Cosmos, Celestia, and Polkadot. Ethereum will never stop improving, neither should polygon.

This vision reflected in Polygon’s is whithin its acquisition of Zk Roll Up projects and sidechain projects, positioning the platform to launch even more chains in the future.

Looking ahead, the success of Polygon will depend on the activity of the network and the growth of its ecosystem. The most used chains and infrastructure will ultimately determine the longevity of these projects. Some experts predict that in the future, developers will host thousands of chains working alongside Ethereum to reach millions of transactions per second.

Overall, the future of Polygon looks bright as the platform continues to drive the all-inclusive adoption of blockchain technology. The network’s emphasis on scalability, security, and accessibility will be key to its success in the years to come.