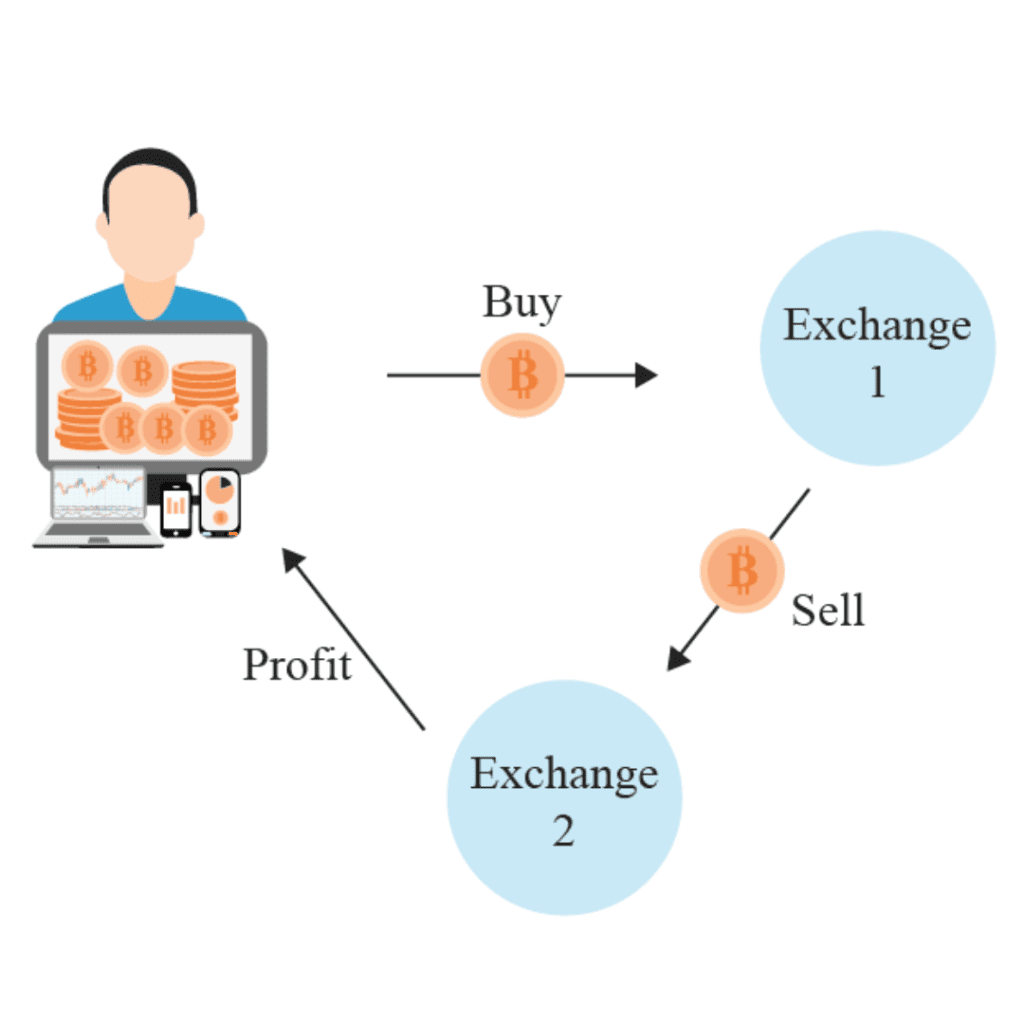

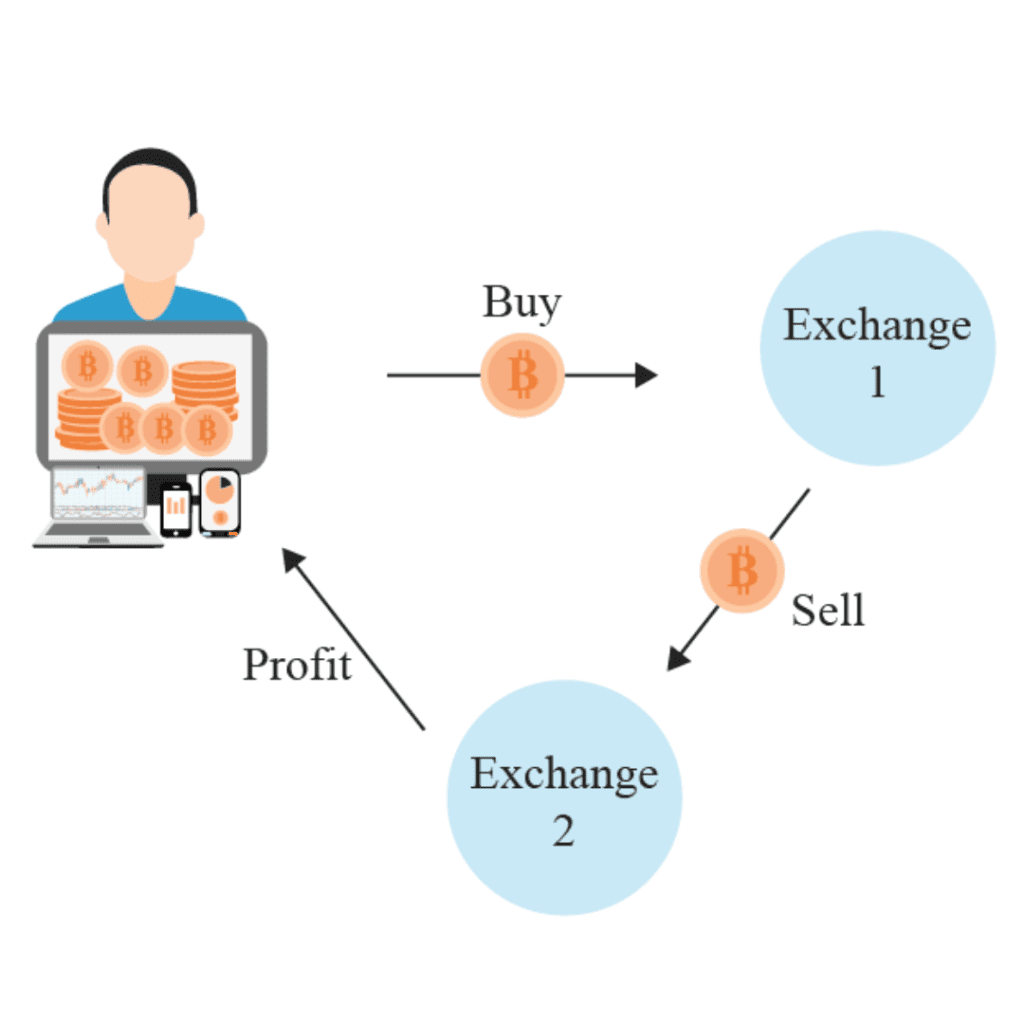

In the fascinating world of cryptocurrencies, trading strategies have evolved to keep pace with market dynamics. Among these strategies, crypto arbitrage trading has carved a significant niche. Drawing from the classical concept of arbitrage, where a trader exploits price discrepancies of the same asset in different markets, crypto arbitrage follows a similar blueprint but within the realm of digital assets.

Understanding the essence of arbitrage is fundamental to comprehending crypto arbitrage trading. To illustrate, let’s take a scenario where a trader purchases a pair of sneakers for $130 on one platform and swiftly sells it on another for $140, pocketing the $10 difference. This practice of capitalizing on price disparity is the heart of arbitrage trading, and it carries over into cryptocurrencies. So, when someone queries, “What is crypto arbitrage?” you can essentially consider it a digital adaptation of the conventional arbitrage method, but with cryptocurrencies in place of sneakers!

Crypto assets, like Bitcoin or Ethereum, may have different prices across multiple exchanges at any given moment, and savvy arbitrage traders seize these fleeting opportunities. It’s vital to remember that the crypto market operates round the clock, making it a fertile ground for arbitrage maneuvers. Now that we’ve answered the “What is crypto arbitrage?” question, let’s dive deeper into its mechanics.

The Mechanics of Crypto Arbitrage Trading

Crypto arbitrage trading hinges on the price discrepancies across various crypto exchanges. Just as two supermarkets in the same town may sell the same product at different prices, so do crypto exchanges. They may offer varying rates for the same digital asset due to differences in supply, demand, and their pricing mechanisms.

These price discrepancies may be minuscule and momentary, but they present a golden opportunity for an astute arbitrage trader. Crypto arbitrage traders need to act swiftly to take advantage of these price differences and secure a profit before the market adjusts and the disparity resolves itself. This need for speed and precision explains why many crypto arbitrage traders rely on automated trading systems or AI arbitrage tools to execute their trades with optimal timing.

Bear in mind, crypto markets operate 24/7, creating countless price variation moments that are ripe for arbitrage. The “always-on” nature of crypto markets is a key reason why crypto arbitrage trading can be more dynamic and potentially profitable compared to traditional arbitrage trading.

Types of Crypto Arbitrage Strategies

Several strategies underpin crypto arbitrage trading, each leveraging unique aspects of the market. Two strategies that stand out in the realm of crypto arbitrage are Triangular Arbitrage and Decentralized Arbitrage.

Triangular Arbitrage is a nuanced strategy that capitalizes on pricing inconsistencies among three different currencies on the same exchange or across multiple exchanges. Triangular arbitrage can be challenging to identify manually due to the complexity involved in tracking three different assets simultaneously. Hence, traders often employ advanced trading tools or algorithms to assist in spotting these triangular opportunities.

Next, Decentralized Arbitrage is another strategy that has gained prominence with the rise of decentralized exchanges (DEXs). In decentralized arbitrage, traders exploit price variations between different DEXs. This form of arbitrage trading offers the benefit of potentially lower costs compared to centralized exchanges, as well as the advantage of maintaining control over one’s private keys throughout the transaction process. Decentralized arbitrage taps into the unique ecosystem of AMMs (Automated Market Makers) and DEXs, embodying the ethos of decentralization inherent to the cryptocurrency world.

These crypto arbitrage strategies embody the innovative nature of cryptocurrency markets, demonstrating how classic trading concepts have evolved to suit the digital asset environment.

Calculating Cryptocurrency Pricing: Centralized vs. Decentralized Exchanges

Understanding how crypto prices are determined in different types of exchanges is key to recognizing and leveraging arbitrage opportunities. There are two main types of exchanges: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

In centralized exchanges like Binance or Coinbase, the exchange acts as an intermediary between buyers and sellers. The prices are primarily dictated by supply and demand dynamics. When the buying pressure exceeds the selling pressure, the price goes up. Conversely, when sellers outnumber buyers, the price drops. Centralized exchanges often have higher trading volumes, leading to greater liquidity and potentially less drastic price volatility compared to DEXs.

On the other hand, decentralized exchanges such as Uniswap or SushiSwap operate without a central authority, enabling direct peer-to-peer transactions. The pricing mechanism here is based on Automated Market Makers (AMMs), which maintain liquidity pools of various token pairs. The prices of cryptocurrencies on DEXs are determined by the ratio of the tokens in these pools.

These contrasting pricing mechanisms and market dynamics between CEXs and DEXs frequently give rise to price discrepancies, providing arbitrage opportunities for traders.

Risks Involved in Crypto Arbitrage Trading

While crypto arbitrage trading may sound appealing, it’s essential to recognize the risks involved. These include:

1. Price Slippage: This occurs when the actual execution price of a trade differs from the expected price, especially in cases of large volume orders. The market can move against the trader in the time it takes to execute the trade, potentially erasing the arbitrage opportunity.

2. Exchange Risk: The choice of exchange matters, as they vary in terms of reliability, security, and fees. Unforeseen issues like hacking incidents, sudden fee changes, or downtime can impact the profitability of arbitrage trading.

3. Regulatory Risk: As regulations around cryptocurrency are still evolving worldwide, changes in laws can impact the availability or legality of arbitrage opportunities.

4. Transaction Time Risk: Crypto transactions aren’t always instantaneous, and delays can occur due to network congestion. In the time it takes to transfer funds from one exchange to another, the price difference might evaporate.

5. Liquidity Risk: In smaller exchanges or for less popular crypto assets, low liquidity might prevent the trader from buying or selling the necessary amount of an asset without influencing its price, which can ruin an arbitrage opportunity.

Wrapping Up: Is Crypto Arbitrage Trading for You?

Crypto arbitrage trading offers a method to potentially secure profits by capitalizing on price differences across various exchanges. However, it’s not without challenges. Traders need a deep understanding of the crypto market, agility to act quickly, and advanced tools to detect and capitalize on opportunities as they arise.

The inherent risks, such as price slippage, exchange risk, regulatory changes, transaction delays, and liquidity issues, can diminish the potential profitability of arbitrage trades. Therefore, it is essential to have a robust risk management strategy in place if you’re considering this approach.

Crypto arbitrage trading may suit those who enjoy staying on top of market movements and are comfortable with navigating the complexities of the crypto ecosystem. Remember, all forms of trading involve risk, and it’s essential to trade responsibly and understand the market dynamics before diving in.