In today’s digital age, the rise of cryptocurrency and e-commerce has led to an unprecedented number of online transactions. With the majority of these transactions occurring between parties who have no prior personal knowledge of one another, the need for a trusted intermediary has never been greater. Enter the world of escrow providers or escrow services, a centuries-old concept now adapted for the modern era. These intermediaries have been used to enhance transactional security in traditional finance for ages, but how do they affect Bitcoin and the world of cryptocurrency? In this article, we’ll explore not only what escrow services are but also how they have evolved to meet the unique demands of the crypto landscape, specially Bitcoin. From the basic layout of escrow to the best anonymous crypto escrow services, we’ll delve into the intricacies of this fascinating subject.

What is Escrow?

Escrow is a legal agreement used to protect the interests of both parties involved in a transaction. It facilitates the secure exchange of goods or services by having a third party hold onto the property or money until both parties fulfill their obligations. Escrow systems have been around for hundreds of years, ensuring transactional security, especially when the transacting parties are unknown to each other. Traditional escrow services deal solely with fiat currencies, but what happens when we introduce cryptocurrencies like Bitcoin (BTC) and Ether (ETH) into the mix? The practices remain similar, but the landscape changes, offering new opportunities and challenges.

What is Bitcoin Escrow?

Bitcoin Escrow is a decentralized service designed to act as a neutral representative for transactional confidence between two or more unacquainted parties. Unlike traditional escrow, where banks and financial institutions perform the intermediary function, Bitcoin Escrow leverages the in-built security of blockchain encryption. This underlying technology eliminates the need for costly legal documentation, making it a form of decentralized finance (DeFi).

This process can be further enhanced using 2-of-3 MULTISIG or 2-of-2 MULTISIG transactions, allowing for elegant methodologies that put a cryptocurrency twist on traditional escrow. Whether through incentive options or time lock options, Bitcoin Escrow takes another step closer to true decentralization, protecting both buyers and sellers from potential fraud.

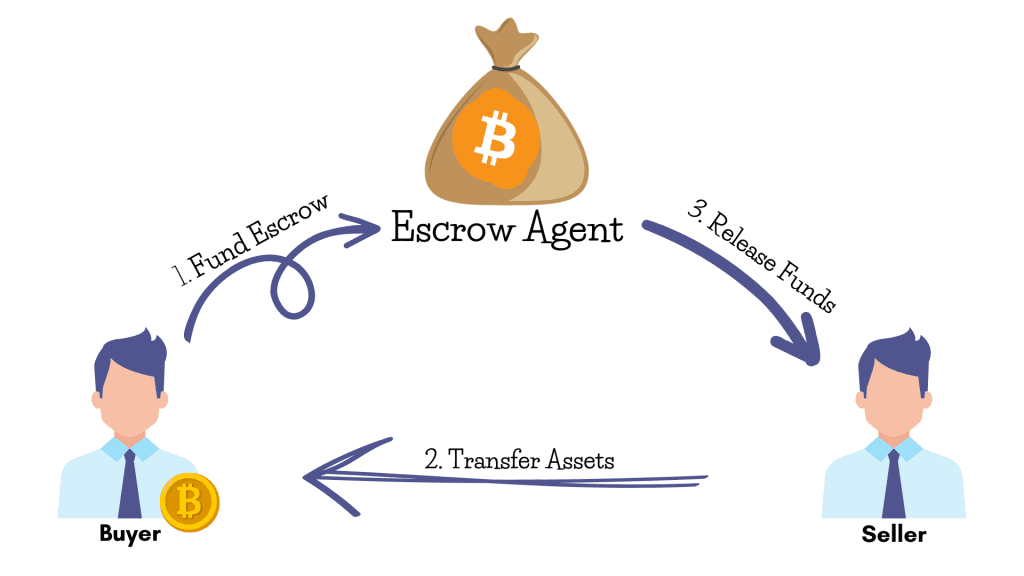

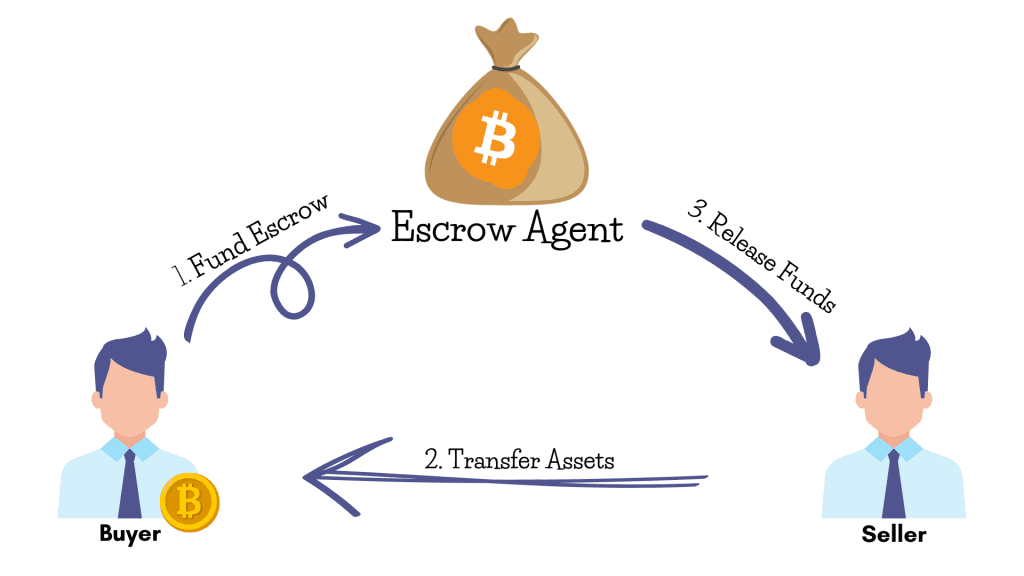

How Does Bitcoin Escrow Work?

Bitcoin Escrow is a fascinating blend of traditional escrow practices and cutting-edge cryptocurrency technology. Here’s how it functions:

- The Buyer’s Commitment: The buyer sends the necessary Bitcoin to the escrow service provider, initiating the transaction.

- Negotiation and Agreement: The funds are held by the escrow provider while the buyer and seller negotiate their terms, ensuring a secure environment for both parties.

- Seller’s Fulfillment: Once the escrow provider confirms that the seller has met their obligations, the funds are released. This step may include a holding period for the buyer to verify satisfaction with the goods or services.

- Completion or Refund: If both parties are satisfied, the escrow provider charges a commission fee, and the transaction is complete. If the buyer is unsatisfied, they can request a refund within the holding period.

Bitcoin Escrow also offers innovative methods like 2-of-3 MULTISIG and 2-of-2 MULTISIG transactions. These approaches allow for elegant solutions that can either involve a third-party or eliminate it altogether. While these methods are still experimental, they represent a step towards true decentralization and offer exciting possibilities for the future of online transactions.

Bitcoin Escrow vs Traditional Escrow Services

The world of escrow has been revolutionized by the introduction of Bitcoin and other cryptocurrencies. Let’s explore the key differences between traditional and Bitcoin Escrow:

- Intermediary Function: Traditional escrow relies on banks and financial institutions, while Bitcoin Escrow leverages blockchain encryption.

- Legal Documentation: Traditional escrow requires costly legal documentation, while Bitcoin Escrow’s decentralized nature eliminates this need.

- Currencies Handled: Traditional escrow deals with fiat currencies, whereas Bitcoin Escrow handles cryptocurrencies like Bitcoin and Ether.

- Decentralization: Bitcoin Escrow is often referred to as a form of decentralized finance (DeFi), allowing for over-the-counter (OTC) practices and separating itself from traditional finance.

These differences highlight the innovative nature of Bitcoin Escrow, adapting age-old practices to the modern digital landscape and offering unique benefits and opportunities.

Top Bitcoin Escrow Service Providers

In the rapidly growing field of Bitcoin Escrow, several service providers stand out for their features, benefits, and reliability:

- BTC Asia: Founded by Colbert Low, BTC Asia is a decentralized crypto escrow service known for its anonymity and competitive fees. It allows users to start using the platform simply by submitting a BTC and email address. However, it’s worth noting that disputes are handled by third-party representatives, not BTC Asia themselves.

- IBC Group: Primarily a blockchain-related fundraising agency, IBC Group also offers a crypto trading escrow service for larger-scale transactions. They adhere to international know-your-customer (KYC) laws, providing better transactional security but excluding true anonymity. Leveraging smart contracts, IBC Group accelerates the process and charges a 1% exchange fee.

These providers, along with others in the market, offer a range of services tailored to different needs and preferences. From anonymity to smart contract functionality, they represent the diverse and innovative landscape of Bitcoin Escrow.

The Problem with Escrow Services

Escrow services, while essential in providing transactional security, are not without challenges and risks. In the context of Bitcoin Escrow, these problems can be magnified due to the decentralized nature of cryptocurrency. Some of the key challenges include:

- Trust Issues: Both traditional finance and cryptocurrency trade are fraught with trust issues. The decentralized nature of Bitcoin Escrow can sometimes lead to disputes that are difficult to resolve.

- Potential for Fraud: While escrow services are designed to prevent fraud, they are not entirely immune to it. System errors, platform-based hacks, or even outright thievery can still occur.

- Complexity of Two-Party Systems: The experimental nature of 2-of-2 MULTISIG transactions, while promising, has kinks that need to be ironed out. The asymmetrical dilemma and the potential for human error or digital miscommunication remain challenges.

Despite these issues, the evolution of Bitcoin Escrow continues to offer solutions and innovations to mitigate these problems, leading us to a more secure and efficient future.

Other Cryptocurrencies and Escrow Services

Bitcoin Escrow is just the tip of the iceberg in the world of cryptocurrency escrow services. Other cryptocurrencies like Ethereum, Litecoin, and Ripple are also adapting escrow services to their unique frameworks. These adaptations are essential as each cryptocurrency operates on different principles and technologies.

The underlying blockchain technology allows for the creation of smart contracts and decentralized applications, opening up new possibilities for escrow services across various cryptocurrencies. The growth of decentralized finance (DeFi) platforms further extends the reach of escrow services, making them adaptable and relevant across the diverse landscape of digital assets.

The Future of Bitcoin Escrow

The future of Bitcoin Escrow is filled with potential and excitement. Current challenges are being met with experimental methods, and the drive towards true decentralization continues to shape the industry. Some key future trends include:

- Enhanced Decentralization: The development of methods like 2-of-3 and 2-of-2 MULTISIG transactions is pushing Bitcoin Escrow closer to true decentralization, reducing reliance on third parties.

- Integration with Smart Contracts: Leveraging smart contracts to automate and secure transactions is a growing trend that will likely shape the future of Bitcoin Escrow.

- Regulatory Compliance: As the industry matures, regulation and compliance with international laws will become increasingly important, balancing the need for security with the principles of decentralization.

The future of Bitcoin Escrow is a dynamic and evolving landscape, driven by technological innovation and the ever-changing needs of the global economy.

Conclusion

Bitcoin Escrow represents a significant evolution in the world of finance, blending traditional escrow practices with the revolutionary technology of cryptocurrency. From providing transactional security to enabling true decentralization, Bitcoin Escrow is reshaping the way we conduct business online.

The challenges and risks associated with Bitcoin Escrow are being met with innovation and experimentation. The adaptation of escrow services across various cryptocurrencies and the promising future trends highlight the resilience and potential of this industry.

As we look to the future, the exploration of Bitcoin Escrow offers not just a glimpse into the future of finance but a call to action for individuals and businesses to engage with this exciting and transformative field.