You’ve probably heard of cryptocurrencies like Bitcoin and Ethereum, but have you ever wondered about the technology that powers these digital assets? Well, look no further! We’re about to embark on an exciting journey to uncover the world of ERC-20 tokens and their role within the Ethereum network. In this article, we’ll demystify these tokens, explore their functionality, and reveal their significance in the ever-evolving world of blockchain technology. So, buckle up, dear reader, as we dive into the fascinating realm of Ethereum and ERC-20 tokens!

Ethereum Network and Smart Contracts

Before we delve into the specifics of ERC-20 tokens, it’s essential to understand the foundation upon which they stand: the Ethereum network. Ethereum is a decentralized, open-source blockchain platform that enables developers to create and deploy smart contracts. These self-executing contracts with the terms of agreement directly written into code are the backbone of the Ethereum ecosystem. They are designed to facilitate, verify, or enforce the negotiation or performance of a contract without the need for a central authority.

Smart contracts play a pivotal role in the creation and management of ERC-20 tokens. They are responsible for keeping track of the created tokens and handling transactions within the Ethereum network. Thanks to the versatility of smart contracts, developers can create tokens that represent virtually anything – from in-game items and reputation points to financial assets like shares or even fiat currencies like USD.

The power of smart contracts doesn’t end there, though! By adhering to specific standards like ERC-20, smart contracts can ensure that these tokens are interoperable with other products and services within the Ethereum ecosystem. This standardization paves the way for seamless integration and widespread adoption of ERC-20 tokens.

Unraveling the ERC-20 Standard

Enter the ERC-20 standard, the backbone of the tokenized world on Ethereum. Proposed by Fabian Vogelsteller in November 2015, ERC-20 provides a set of rules that ensure tokens are compatible with other products and services within the Ethereum network. This standardization makes life easier for developers, as well as users who can seamlessly exchange and interact with various tokens.

ERC-20 tokens are fungible, meaning each token is identical in type and value. This makes them similar to cryptocurrencies like Ethereum’s native currency, Ether (ETH). However, it’s essential to note that ERC-20 tokens can represent a wide array of assets, from digital currencies to digital collectibles and beyond.

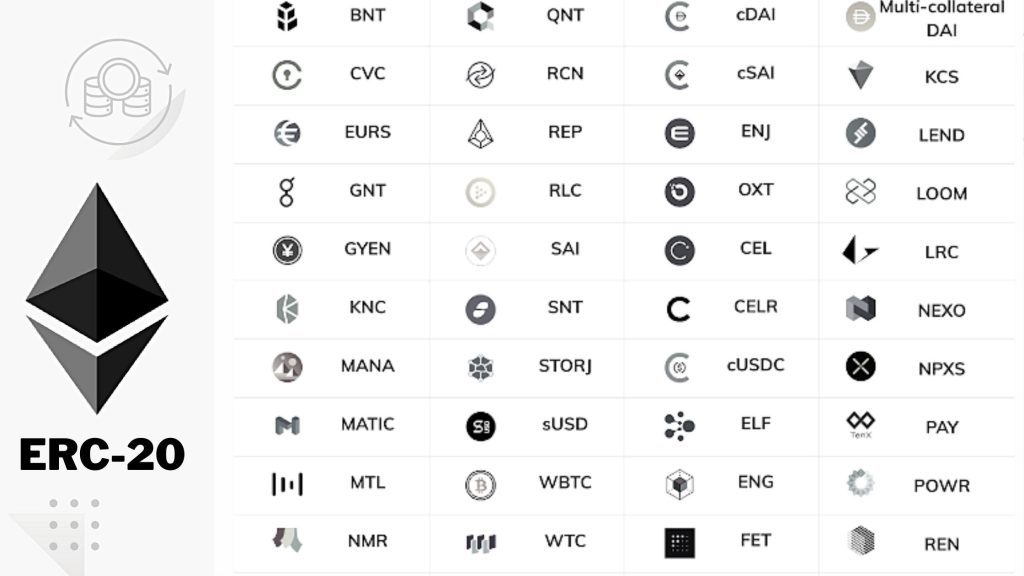

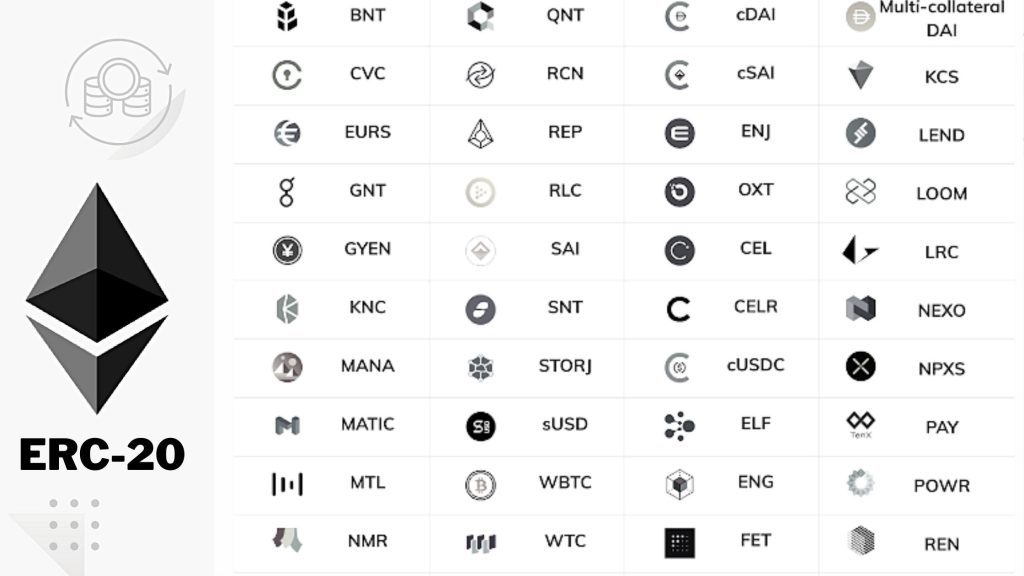

Popular ERC-20 Tokens and Their Impact

The Ethereum network has seen the emergence of countless ERC-20 tokens, each with its unique characteristics and applications. Some of these tokens have made a significant impact on the crypto ecosystem and beyond. Let’s take a closer look at a few of these influential ERC-20 tokens and the impact they’ve had on the world of blockchain.

- Tether (USDT)

- Chainlink (LINK)

- Binance Coin (BNB)

- Basic Attention Token (BAT)

Tether (USDT) is a stablecoin pegged to the US dollar, providing a stable value amidst the volatile world of cryptocurrencies. It has become a popular choice for traders and investors as a means of transferring value between exchanges and hedging against market fluctuations.

Chainlink (LINK) is a decentralized oracle network that connects smart contracts to real-world data, such as price feeds, weather data, and more. This enables smart contracts to access information outside the blockchain, expanding their potential use cases and applications.

Binance Coin (BNB), created by the Binance Exchange, serves as the native currency for the platform and offers users discounted trading fees. BNB has also become a popular choice for initial coin offerings (ICOs) and is used for various purposes within the Binance ecosystem.

Maker (MKR) is the governance token for the MakerDAO decentralized finance (DeFi) platform, which allows users to create and manage the DAI stablecoin. MKR holders participate in the decision-making process for the platform, shaping its development and future direction.

Basic Attention Token (BAT) is designed to revolutionize digital advertising by rewarding users for their attention while providing advertisers with a more efficient and transparent way to reach their target audience. BAT has the potential to disrupt the traditional advertising industry and reshape the way content creators and consumers interact online.

Use Cases and Applications of ERC-20 Tokens

ERC-20 tokens offer a wide array of use cases and applications, making them an essential part of the blockchain ecosystem. From fundraising to decentralized finance, these tokens have the potential to transform industries and create new opportunities. Let’s explore some of the most exciting applications of ERC-20 tokens.

- Initial Coin Offerings (ICOs)

- Decentralized Finance (DeFi) Platforms

- Gaming

- Non-fungible Tokens (NFTs)

- Tokenized Assets

Initial Coin Offerings (ICOs) have been a popular fundraising method for blockchain projects, allowing them to raise capital by issuing ERC-20 tokens to early investors. These tokens often represent a stake in the project or grant access to its products and services.

Decentralized Finance (DeFi) Platforms leverage the power of ERC-20 tokens to create decentralized financial services, such as lending, borrowing, and trading. These platforms eliminate the need for traditional financial intermediaries, enabling users to access financial services in a more open and accessible way.

Gaming has seen a surge of interest in ERC-20 tokens, with developers creating in-game currencies, items, and even characters as tokens. This allows for the creation of truly decentralized gaming economies and opens up new possibilities for player-driven markets and experiences.

Non-fungible Tokens (NFTs) represent unique digital assets like artwork, collectibles, and virtual real estate. While not all NFTs are ERC-20 tokens, many NFT platforms and marketplaces use ERC-20 tokens as their native currency for buying, selling, and trading NFTs.

Tokenized Assets enable the representation of real-world assets, such as gold, real estate, or even shares in a company, as ERC-20 tokens. This allows for the creation of decentralized markets and investment opportunities, making these assets more accessible and tradable for a global audience. Tokenized assets have the potential to democratize access to investment opportunities and reshape traditional financial markets.

Navigating Risks and Challenges Associated with ERC 20 Tokens

While ERC-20 tokens offer numerous benefits and opportunities, they also come with their fair share of challenges and risks. To make informed decisions when engaging with ERC-20 tokens, it’s essential to be aware of these potential pitfalls:

- Regulatory concerns: As the popularity of ERC-20 tokens grows, so does the attention from regulatory bodies. There’s an increasing need for clarity on the legal status of these tokens and their compliance with existing financial regulations. This uncertainty can affect the adoption and development of ERC-20 tokens and their respective projects.

- Security risks: Smart contracts, which govern the behavior of ERC-20 tokens, can be vulnerable to hacking and exploitation if not designed and implemented correctly. This can lead to the loss of funds and other negative consequences for users and projects.

- Network congestion: The Ethereum network can face congestion issues due to the increasing number of transactions and applications built on it. This can lead to slow transaction times and higher gas fees, impacting the overall user experience and limiting the growth of ERC-20 tokens.

Despite these challenges, the potential of ERC-20 tokens remains significant, and developers continue to work on solutions to address these issues, making the ecosystem safer and more efficient for all.

The Future of ERC-20 Tokens

As we’ve explored in this article, ERC-20 tokens play a crucial role in the Ethereum ecosystem, enabling a diverse range of decentralized applications and use cases. The ongoing development of the Ethereum network, including upgrades such as Ethereum 2.0, promises to enhance the scalability and efficiency of the platform, creating more opportunities for ERC-20 tokens to thrive.

Looking ahead, we can anticipate the continued growth and evolution of ERC-20 tokens as they become more deeply integrated into various industries and sectors. From decentralized finance and gaming to tokenized assets and beyond, ERC-20 tokens have the potential to reshape how we interact with digital assets and facilitate new, innovative solutions to real-world challenges.

As a blockchain enthusiast, it’s an exciting time to keep an eye on the ERC-20 token space and stay informed about the latest developments and opportunities. By understanding the risks and challenges, as well as the potential rewards, you’ll be better equipped to navigate the rapidly changing landscape of ERC-20 tokens and the broader Ethereum ecosystem.