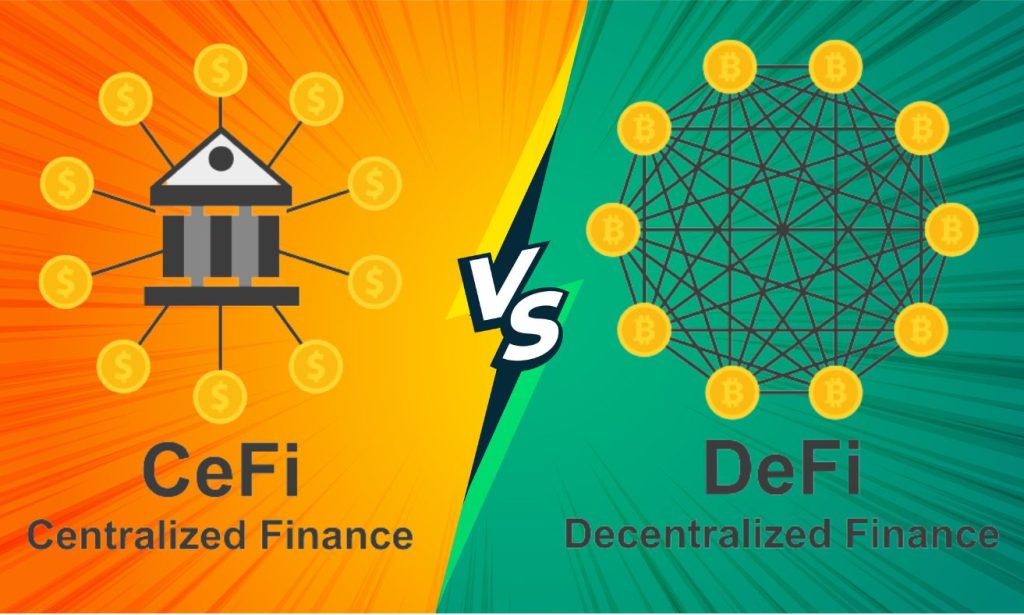

In the new dawn of the digital age, finance is undergoing a significant transformation. The DeFi vs CeFi discussion brings two substantial changes to the financial landscape. Decentralized finance, or DeFi, and centralized finance, or CeFi, are at the forefront of this paradigm shift. To put it simply, these terms refer to the methodology of how financial services are administered in the world of cryptocurrencies.

DeFi, the decentralised player, is a system by which financial products become available on a public decentralized blockchain network, making them open to anyone to use. Meanwhile, CeFi, the centralized counterpart, mimics traditional banking but within the crypto space, where a central authority oversees financial services.

In the grand scheme of financial evolution, both DeFi and CeFi are leaving their unique imprint. Just as the advent of the internet created ripples that shaped our world, DeFi and CeFi are redefining the contours of finance and how we interact with money. This doesn’t mean you need to take sides in the DeFi vs CeFi debate; instead, it’s about understanding the unique benefits and potential drawbacks of each to navigate this new financial terrain.

Understanding DeFi in the Crypto Sphere: A Revolution in Finance

Let’s embark on a deeper exploration into the world of DeFi. Picture this: You’re an ambitious entrepreneur, you’ve got an innovative idea, and you’re eager to transform it into a reality. In a conventional setting, this means embarking on a complex journey involving banks, paperwork, and stringent requirements – not to mention the time spent waiting for approvals.

Enter DeFi – the revolution in finance that promises to dismantle these barriers. By utilizing the power of blockchain technology, DeFi gives you direct access to a plethora of financial services. Whether it’s borrowing funds, trading assets, or even earning interest, you don’t need a bank or an intermediary.

DeFi projects like MakerDAO and Compound are excellent examples of this disruption. They’re akin to the early internet pioneers, challenging the status quo and setting the stage for a world where financial inclusivity is no longer a dream, but a reality. MakerDAO, for instance, allows users to take out a loan in DAI (a stablecoin) against collateral in other cryptocurrencies, all without needing to go through credit checks or paperwork. Compound, on the other hand, has designed an algorithmic, autonomous interest rate protocol for developers to unlock a universe of open financial applications.

In this way, DeFi isn’t just changing the way we access and interact with money—it’s ushering in an era of financial democratization where everyone, regardless of their socio-economic status or geographic location, can participate in the global economy.

A Closer Look at CeFi in Crypto: Trusting the Traditional

Now that we’ve unveiled the disruptive power of DeFi, let’s delve into CeFi’s role in the crypto world. If DeFi is the daring innovator, CeFi is the stable bridge between the traditional and the futuristic, blending conventional banking with the dynamic world of cryptocurrencies.

CeFi operates under the premise that not everyone wants to deal with the complexities of managing their financial operations on a blockchain. Imagine you are a retiree who has managed to accumulate a decent savings portfolio. While you might be intrigued by the earning potential of crypto investments, you might not have the technical know-how or even the inclination to navigate decentralized platforms.

Enter CeFi platforms, like Binance and Celsius. They act as intermediaries, providing a user-friendly interface that connects users to the crypto world. They offer a range of services, such as earning interest on your deposited crypto, lending, and trading, all under their supervision. Celsius, for instance, allows users to earn up to 17% APY on their crypto holdings, something a traditional savings account could never match.

One might argue that the advent of CeFi in the crypto space is reminiscent of the early days of online banking. It represents a point of convergence between the comfort of the familiar and the thrill of the new, allowing users to participate in the crypto economy without letting go of the conventional practices they’ve grown accustomed to.

DeFi vs CeFi: Comparing the Similarities

In the DeFi vs CeFi debate, it’s easy to get caught up in the differences, the novelty, and the disruption. However, it’s equally crucial to zoom in on their similarities as they share a common ground in many ways. Both DeFi and CeFi represent innovative adaptations of finance within the realm of blockchain and cryptocurrencies.

Whether you choose to engage with DeFi protocols or CeFi platforms, both avenues allow you to experience the benefits of the crypto economy, including the ability to earn interest, take out loans, and trade assets.

Another shared trait is the ambition to improve upon the traditional financial system, aiming for greater efficiency, inclusivity, and yield potential. Although their approaches differ, both DeFi and CeFi have been built with the same revolutionary DNA — blockchain — and are designed to push the boundaries of what’s possible in the world of finance.

In essence, the DeFi vs CeFi conversation is less about choosing a side and more about understanding the advantages each brings to the table. They are two sides of the same crypto coin, each addressing different needs and preferences in the evolving financial landscape.

Applications of DeFi and CeFi: Broadening the Financial Scope

As we navigate the fascinating world of DeFi and CeFi, it’s essential to recognize their transformative potential. They’re not just concepts or trending buzzwords in the crypto sphere, but real, practical solutions that are redefining how we interact with finance.

DeFi’s groundbreaking applications range from decentralized exchanges (DEXs) to yield farming platforms. DEXs, like Uniswap or PancakeSwap, are permissionless platforms that enable peer-to-peer trading of cryptocurrencies without the need for an intermediary. Yield farming, another DeFi application, involves lending or staking your crypto assets in return for potentially high rewards. Think of it as a high-yield savings account, only instead of a bank, you’re dealing with smart contracts on the blockchain.

In contrast, CeFi applications mirror those of traditional banking services, albeit turbocharged with blockchain’s capabilities. Platforms like Binance offer cryptocurrency exchange services where users can trade one type of cryptocurrency for another. They also provide interest-earning savings accounts for users who prefer to hold their assets rather than trade. Platforms like Celsius and BlockFi offer crypto-backed loans, giving users access to liquidity without needing to sell their assets.

What this shows is the growing adaptability and versatility of financial operations, thanks to the introduction of DeFi and CeFi. With each new development, we are seeing an expansion of financial opportunities that were once considered unthinkable.

DeFi vs CeFi: Evaluating Investment Prospects

The world of crypto is not just about digital currencies but also about opportunities for investment. Whether it’s DeFi or CeFi, each presents unique prospects for investors willing to step into the evolving crypto scene.

Investing in DeFi could involve providing liquidity to a DEX or yield farming platform. By staking your assets, you could potentially earn returns in the form of trading fees or yield farming rewards. However, it’s important to remember that these investment strategies often require a certain level of technical expertise and are subject to high volatility and risk.

CeFi, on the other hand, offers a more familiar investment terrain. Investing in CeFi could mean depositing your assets on a platform like Binance or Celsius to earn interest, or lending your assets for a return. These platforms function similarly to a traditional bank but with potentially higher interest rates. CeFi platforms also offer a level of customer service that many find comforting, similar to the relationship you might have with your traditional bank.

When considering DeFi vs CeFi from an investment perspective, it boils down to your risk tolerance, technical knowledge, and preference for independence or guidance. It’s all about finding the balance that works for you in the exciting, fast-paced world of crypto finance.