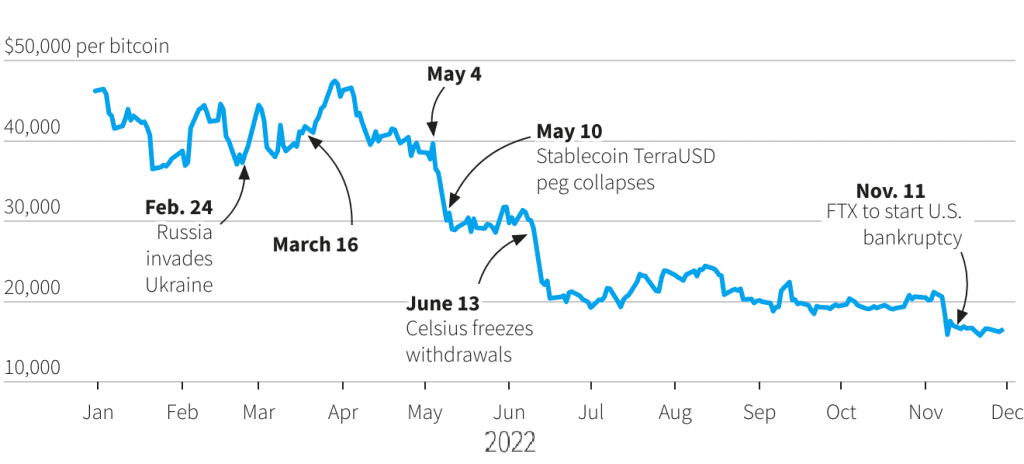

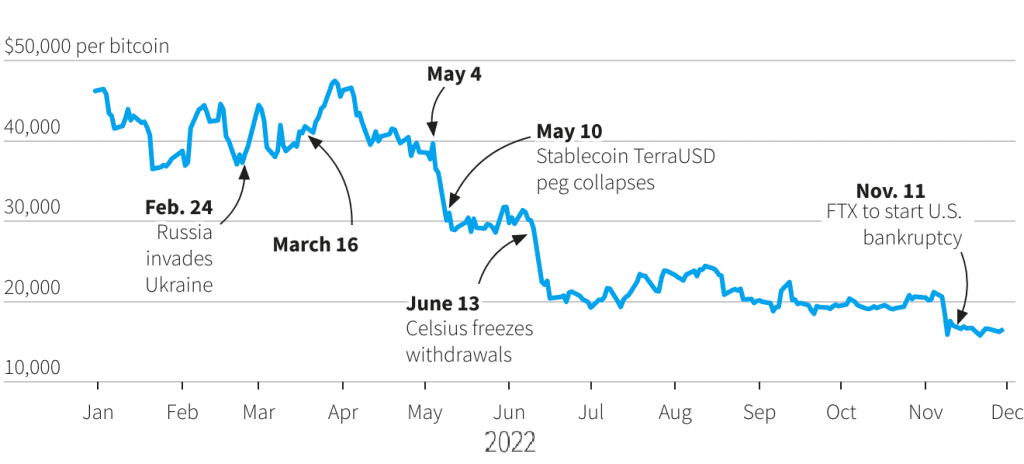

2022 will forever be remembered for the crypto crash, a tumultuous period that witnessed the dizzying highs and devastating lows of digital currencies. Early in the year, Bitcoin’s crash was unimaginable as cryptocurrencies were dominating headlines, reaching unprecedented values, and entering mainstream culture. What happened to crypto? By year’s end, the boom had turned to bust, leaving many investors reeling and searching for answers.

Ripple’s XRP, in particular, experienced a remarkable journey, recently culminating in a landmark legal victory over the SEC. This victory sent shockwaves through the crypto world and led to a 75% surge in the value of XRP in just one day. But this triumph didn’t come without its challenges, as Ripple’s path has been fraught with legal battles, market volatility, and regulatory scrutiny. This tale of triumph and turbulence serves as a microcosm of the broader crypto industry, reflecting both its immense potential and the significant hurdles it faces.

The Dawn of Crypto Hype: How it Began

The emergence of cryptocurrencies marked a turning point in the global financial landscape. Bitcoin, the pioneer of the crypto revolution, was created in 2009 by an unknown entity known as Satoshi Nakamoto. But it wasn’t until 2017 that the crypto hype truly began to gain traction.

In that year, Bitcoin’s price soared from just under $1,000 to nearly $20,000, catalyzing a frenzy of investment and innovation. Ethereum, Ripple’s XRP, and other altcoins followed suit, enjoying exponential gains. Startups like Coinbase emerged, providing user-friendly platforms for buying and trading cryptocurrencies.

Real-world adoption began to take shape as well, with companies like Overstock accepting Bitcoin payments. ICOs (Initial Coin Offerings) became a popular way for new crypto projects to raise funds, further fueling the hype.

This period wasn’t just about rapid financial gains; it marked a shift in thinking. Cryptocurrencies promised decentralization, transparency, and a challenge to traditional banking systems. The hype was not merely about speculation; it was a belief in a new financial paradigm.

Federal Reserve’s Impact: The Crypto Shockwave

The relationship between cryptocurrencies and traditional financial regulators, such as the Federal Reserve, has been complex and often contentious. The Federal Reserve’s policies have had both direct and indirect impacts on the crypto market.

For example, the Federal Reserve’s decision to cut interest rates in response to the COVID-19 pandemic led to a flood of liquidity in the market. With traditional savings and bonds yielding lower returns, investors looked for alternative investment opportunities, including cryptocurrencies.

Conversely, statements and actions by the Federal Reserve concerning potential regulation and skepticism towards cryptocurrencies have caused significant market volatility. In 2018, when the Federal Reserve Chairman expressed concerns over crypto’s potential for money laundering, the market responded with a sharp decline.

The Federal Reserve’s actions and policies, whether intentional or not, have sent shockwaves through the crypto market. They illustrate the interconnectedness of traditional financial systems with the new digital economy and highlight the delicate balance that must be maintained to foster innovation while ensuring stability and consumer protection.

As the story of cryptocurrencies continues to unfold, these chapters of hype, regulation, and innovation provide valuable insights into the promises and challenges of a digital financial future. Ripple’s recent victory in the SEC case serves as a notable milestone, but the journey is far from over. The lessons learned from the meteoric rise and subsequent fall of cryptocurrencies will undoubtedly shape the industry’s path forward, with the potential to redefine our understanding of money, investment, and economic empowerment.

Failures and Frauds: The Cracks in the System

The meteoric rise of cryptocurrencies wasn’t without its dark side. As the market swelled, so did the number of failures and frauds, exposing the cracks in the nascent system.

One notable failure was the collapse of Mt. Gox, once the world’s largest Bitcoin exchange, which filed for bankruptcy in 2014. The loss of 850,000 Bitcoins, valued at approximately $450 million at the time, sent shockwaves through the community. An investigation revealed poor management and a lack of security protocols as contributing factors.

Fraudulent schemes have also plagued the crypto world. Bitconnect, promising astronomical returns, was exposed as a Ponzi scheme in 2018. Investors lost billions, leading to legal actions and heightened scrutiny by regulators.

These failures and frauds underscore the importance of robust regulatory frameworks, transparent practices, and consumer education. They have prompted calls for stronger oversight and have served as painful lessons for both investors and the industry as a whole.

FTX’s Collapse: A Significant Blow to the Crypto World

The collapse of FTX, one of the largest and most prominent crypto exchanges, marked a significant blow to the cryptocurrency world. FTX’s downfall began with a series of regulatory actions taken against it by various governments and culminated in massive financial losses.

FTX’s failure to comply with local laws led to fines, asset seizures, and the eventual suspension of operations in several countries. The lack of proper governance and risk management practices exposed the platform to vulnerabilities that were ruthlessly exploited by market manipulators.

FTX’s bankruptcy was nothing short of catastrophic. Once valued at $32 billion, its sudden collapse left the crypto world stunned. Criminal charges against its founder, Sam Bankman-Fried, were the headline of what might have been the biggest event in crypto’s history. This wasn’t merely a case of cryptos dropping; it was a seismic event that rippled across the entire crypto landscape.

Binance’s Struggles and the Ripple Effect

Binance, another titan in the cryptocurrency space, has faced its share of struggles, shedding light on the challenges that even well-established platforms can encounter.

Regulatory pressures have been at the forefront of Binance’s issues. In 2021, regulatory bodies in the UK, Japan, and Canada took action against the exchange for operating without proper authorization. These actions led to banking restrictions and hampered Binance’s ability to operate in certain jurisdictions.

The struggles of Binance had a ripple effect on the broader crypto community. Other exchanges faced increased scrutiny, and the regulatory clampdown prompted a renewed focus on compliance across the industry.

The challenges faced by Binance also highlight the shifting landscape of regulatory expectations, emphasizing that agility, transparency, and adherence to local laws are crucial for longevity and success in the complex world of digital assets.

The Future Outlook: Uncertainty and Skepticism

The crypto crash of 2022 left the industry at a crossroads, prompting a wide spectrum of opinions about what lies ahead. Amidst the uncertainty, two distinct camps emerged: the believers and the skeptics.

Believers remain steadfast in their conviction that cryptocurrencies are here to stay. They point to the underlying technology, blockchain, and its potential to revolutionize various industries beyond finance. Optimists believe that the crash was a necessary correction, purging the market of excess speculation and unsustainable projects. They see the setback as an opportunity for innovation to thrive, with cryptocurrencies evolving to serve practical use cases, from decentralized finance (DeFi) to non-fungible tokens (NFTs).

Skeptics, however, see the crash as confirmation of their concerns. They argue that the volatility and lack of regulation inherent in the crypto market make it ripe for manipulation and fraud. The collapse of prominent exchanges and the proliferation of scams only reinforce their doubts. Skeptics emphasize the need for stricter oversight, investor protection, and thorough examination of each cryptocurrency’s utility and viability.

Both perspectives acknowledge the need for clarity in regulatory frameworks. While the believers look forward to a future where governments embrace and integrate cryptocurrencies, the skeptics call for regulations that ensure consumer safety and market integrity.

The Complexity of a Digital Frontier

The crypto crash of 2022 served as a stark reminder of the complexity inherent in navigating the uncharted waters of the digital frontier. It underscored that the promise of immense wealth could quickly turn into the reality of significant losses. The events of that year highlighted the importance of understanding the nuances, risks, and potential rewards associated with cryptocurrencies.

As the dust settled, one thing became clear: the journey ahead will be marked by a constant interplay of technological innovation, regulatory evolution, market speculation, and investor education. The 2022 crypto crash was a catalyst for introspection, prompting both industry insiders and newcomers to reevaluate their strategies and expectations.

While the cryptocurrency industry has shown resilience and adaptability, it is a landscape that defies easy categorization. It is simultaneously a realm of transformative potential and a breeding ground for speculation. It is a space where groundbreaking ideas collide with regulatory challenges and where innovation coexists with volatility.

The crypto crash of 2022 serves as a chapter in the ongoing narrative of a digital revolution that is reshaping how we perceive and interact with finance, technology, and each other. As the industry continues to evolve, one thing remains certain: the journey is far from over, and the story is still being written.