Crypto winter is a phenomenon that every investor in the crypto market must understand. It’s a period marked by a significant fall in the prices of major cryptocurrencies from their all-time highs. Crypto winter is akin to the traditional bear market in the stock exchange, characterized by pessimism, falling prices, and a general decline in economic activity. However, the concept of Crypto winters extends beyond mere price drops, encompassing wider market effects and influencing investor behavior.

Historically, several crypto winters have chilled the market. For instance, the market crash of early 2018 is a notable crypto winter that witnessed a massive downturn in the prices of most cryptocurrencies. Nevertheless, these periods can’t be precisely predicted, due to the inherent volatility of the crypto market.

Impact of Crypto Winter

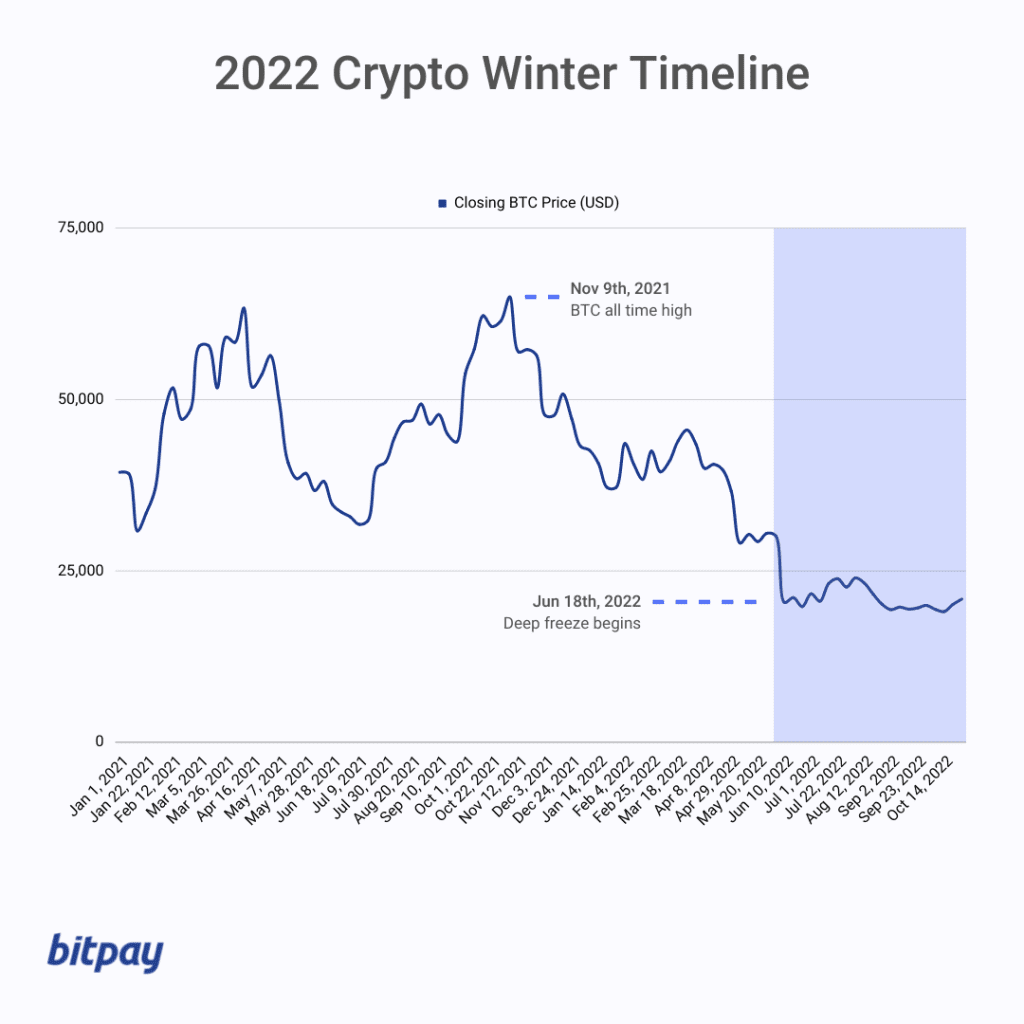

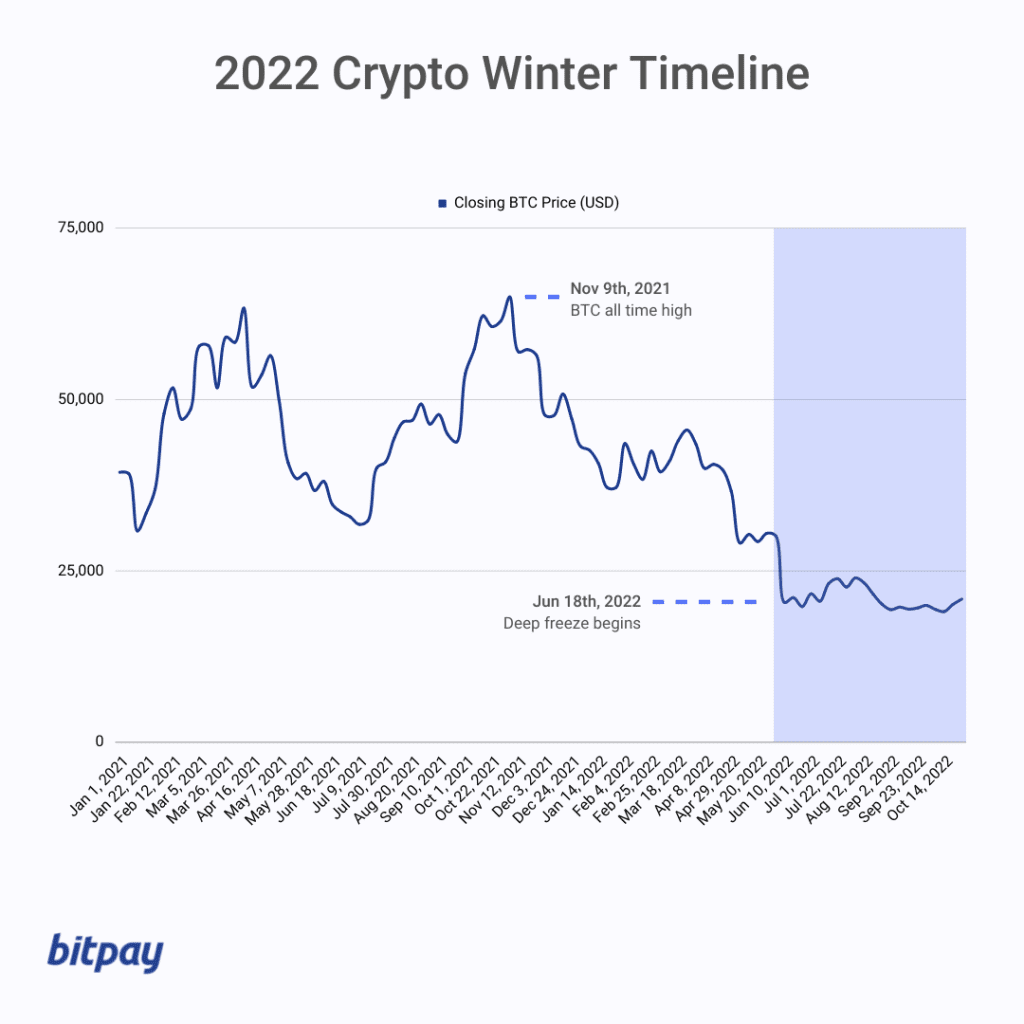

A crypto winter could be triggered by a host of factors including market crashes, regulatory changes, exchange hacks, and breakdowns. For instance, in 2022, the crypto winter was significantly influenced by a steep sell-off from Bitcoin’s previous all-time high of $68,000 in November 2021. By mid-June 2022, Bitcoin’s price had dipped by nearly 70%.

Market crashes have far-reaching consequences on the prices of cryptocurrencies and significantly impact investor sentiment. Similarly, exchange hacks, often resulting in loss of millions of dollars, and regulatory changes such as bans on cryptocurrency trading or freezes on related payments, negatively affect the stability of the market and trigger this scenario. The impacts of these triggers ripple through the entire crypto market, affecting not just crypto exchanges, but also regular users.

Surviving and Thriving 101

A crypto winter can be a challenging time for investors and companies alike. However, like all winters, it does come with its own set of silver linings. Investors can mitigate risks by diversifying their portfolio and keeping a keen eye on market trends. Simultaneously, companies often resort to cost-cutting measures and sometimes job losses.

Interestingly, a crypto winter also functions as a kind of purification process, weeding out weaker startups and allowing stronger ones to showcase their resilience and innovation. The previous crypto winter, spanning from January 2018 to December 2020, is a testament to this process where it played a crucial role in shaping the market and separating the wheat from the chaff.

In conclusion, navigating a crypto winter can be a daunting task, but with the right strategies and mindset, not only can one survive the chilling winds of a crypto winter, but also come out stronger and more prepared for future market dynamics.

Signs of Thawing: When will be Over?

Determining the end of a crypto winter can be a tricky endeavor, much like predicting its onset. However, there are key indicators that investors and market watchers can focus on to gauge if the chilling winds of the crypto winter are beginning to subside. For instance, a steady recovery in the prices of major cryptocurrencies from their lowest points is often a positive sign.

Similarly, an increase in market activity, characterized by more investments, new projects, and heightened investor interest, could signal the end of a crypto winter. For instance, in early 2023, certain market trends signaled the end of the crypto winter. A notable increase in the prices of major cryptocurrencies and a surge in market activity were key signs of a market thaw.

Nevertheless, a definitive end to a crypto winter is often declared retrospectively when the market has entered a new phase of growth, and prices have stabilized. Additionally, expert views can provide valuable insights into the potential end of a crypto winter, but it’s essential to remember that these are often just educated guesses and not foolproof predictions.

Looking Ahead: Future Winters and Market Forecast-Predictions

Given the volatile nature of the cryptocurrency market, predicting future crypto winters is challenging. However, learning from the past and observing the triggers that led to previous crypto winters can provide a semblance of preparedness.

As we move ahead, it’s safe to anticipate that future crypto winters could follow similar patterns as the past, with market crashes, regulatory changes, and exchange hacks playing significant roles. It is also plausible that new triggers could emerge, given the evolving nature of the cryptocurrency landscape.

In the face of potential future crypto winters, preparations could involve developing risk management strategies, diversifying investments, and staying abreast of the latest trends and changes in the crypto market. With the rapidly evolving landscape of the crypto market, resilience and adaptability will be key to weathering future crypto winters.

In conclusion, while the exact timing and triggers of future cryptocurrency winters remain unpredictable, learning from the past, staying prepared, and adapting to changes could help investors and the broader crypto market navigate these challenging periods effectively.