When we talk about the Crypto Fear and Greed Index, we’re delving into the complex psychology that drives the crypto market. This index, as its name suggests, measures the prevailing sentiment in the cryptocurrency market, oscillating between two extreme emotional states: fear and greed. It’s like the weather report of the crypto world, hinting at whether a storm or calm seas lie ahead.

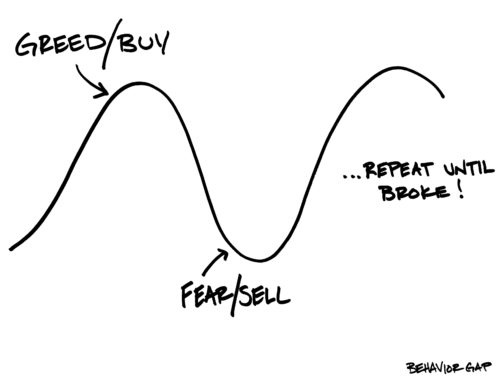

Fear generally kicks in when prices are dropping, and investors are worried about losing their investments. In this state, the market may undervalue cryptocurrencies, and bargains can potentially be found. On the other hand, greed usually appears when prices are soaring, and everyone is trying to get a piece of the action. This rush can lead to inflated prices and a potential market bubble.

Therefore, understanding the Crypto Fear and Greed Index can offer crucial insights. It helps traders predict possible price movements, not based on numerical data or complicated algorithms, but based on collective investor psychology. It’s like having a finger on the pulse of the market, feeling its throbbing heartbeat of fear or greed.

Delving Deeper into the Concept of a Market Index

When we think about a market index, we usually think about financial metrics and hard data. But what’s the real essence of an index? In its simplest form, a market index acts as a yardstick, a benchmark for comparing the performance of individual investments to a broad section of the market. It provides a summary of market conditions and an indication of market trends.

For example, if you’ve invested in a tech company, you might compare its performance to the NASDAQ Composite, a major index heavily weighted toward tech stocks. If your investment is outperforming the NASDAQ, you’re likely doing something right.

However, the Crypto Fear and Greed Index is a different type of index. It doesn’t measure financial performance or track a specific basket of cryptocurrencies. Instead, it gauges the emotional state of the market, providing a different but equally important perspective.

Deciphering Market Indicators in Crypto Trading: A Deeper Look

Market indicators are like the language of the markets. Just as a physician uses a patient’s vital signs to diagnose their health, a trader uses market indicators to understand the health of the market. These indicators can come in many forms, and they serve different purposes.

Firstly, we have technical indicators. These are statistical tools that traders use to interpret price data. They can help identify trends, predict future price movements, and provide buy or sell signals. Common technical indicators include moving averages, relative strength index (RSI), and MACD (moving average convergence divergence).

Secondly, we have fundamental indicators. Unlike technical indicators, fundamental indicators don’t focus on price movement. Instead, they look at a cryptocurrency’s intrinsic value. This could involve studying the project’s whitepaper, the team behind it, its use case, and its current and potential future adoption.

Last but not least, we have sentiment indicators, which is where the Crypto Fear and Greed Index comes into play. Rather than focusing on price data or intrinsic value, sentiment indicators aim to measure the collective mood of the market. They provide insights into how investors are feeling, which can often drive market movements. Understanding these three types of indicators is key to developing a well-rounded trading strategy.

Tracing Back the Origins of the Fear and Greed Index and Its Adoption in the Crypto Sphere

The concept of the Fear and Greed Index didn’t originate in the crypto realm; it was first used in traditional finance. The idea was to create an indicator that could help investors get a sense of the market’s emotional state and thus anticipate potential market swings caused by fear or greed.

CNN Money introduced the original Fear and Greed Index, which focused on the stock market, using multiple data sources like stock price momentum, market volatility, and safe-haven demand. It aimed to help investors sidestep the emotional pitfalls in investing, offering a more rational approach to market trends.

The idea was a hit, and it didn’t take long for it to be adapted to the burgeoning field of cryptocurrency. The Crypto Fear and Greed Index was born, giving crypto traders a tool to gauge market sentiment. Given the volatile nature of cryptocurrencies, where prices can soar or plummet in a matter of hours, this index has proven to be a valuable tool in the crypto trader’s arsenal. You can visit their official website here.

Decoding the Functioning of the Crypto Fear and Greed Index

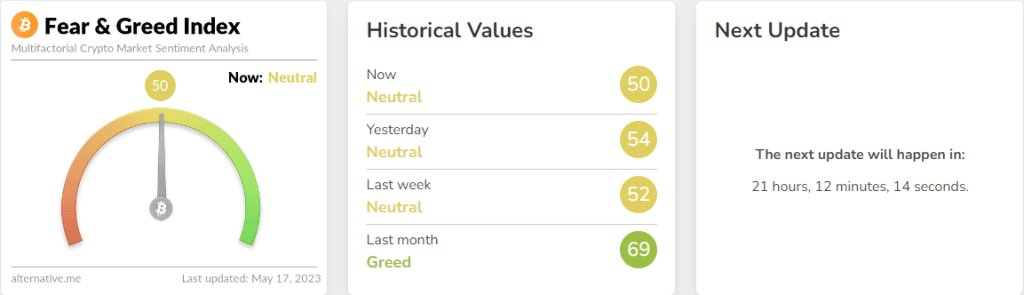

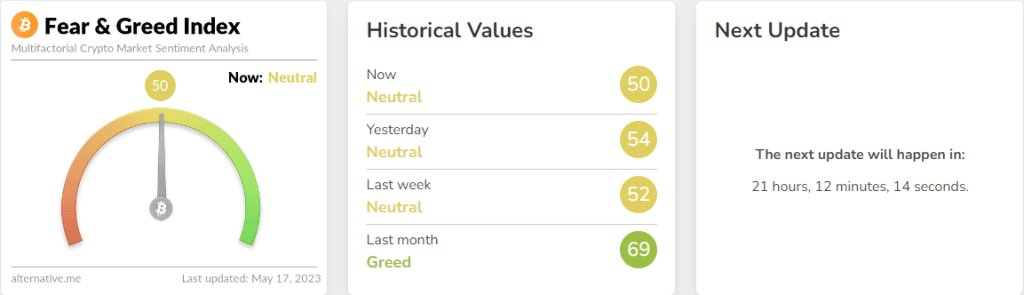

The Crypto Fear and Greed Index works by analyzing a range of data sources and then distilling all of this information into a single, easy-to-understand value. This value ranges between 0 to 100, with 0 representing “Extreme Fear” and 100 representing “Extreme Greed”.

Different data points are used to calculate this value, including volatility, market momentum and volume, social media sentiment, surveys, dominance, and trends. These factors are then combined using a sophisticated algorithm to produce the final index value.

It’s important to note that the index isn’t forecasting specific price movements. Instead, it’s presenting an overview of the market sentiment. It’s up to traders to interpret this data and incorporate it into their trading strategy.

Leveraging the Crypto Fear and Greed Index in Investment Decisions

So, how can you use the Crypto Fear and Greed Index in your trading decisions? The basic principle comes from the legendary investor Warren Buffet: “Be fearful when others are greedy and greedy when others are fearful.”

When the index is showing signs of Extreme Greed, it suggests that investors might be getting overly excited and pushing prices beyond their true value. This could be a sign that a correction is due, and it might be a good time to take profits or wait on the sidelines.

On the other hand, when the index is indicating Extreme Fear, it could mean that investors are panicking and selling off their assets, potentially undervaluing them. This could present buying opportunities.

However, it’s crucial to remember that the Crypto Fear and Greed Index is just one tool in a trader’s toolkit. It should be used in conjunction with other forms of analysis, whether that’s technical analysis, fundamental analysis, or other sentiment indicators. After all, successful trading isn’t about finding a magic bullet; it’s about combining multiple perspectives to make informed decisions.

Using the Crypto Fear and Greed Index for Long-term Analysis

While many traders use the Crypto Fear and Greed Index for short-term trading decisions, it’s also a valuable tool for long-term analysis. Let’s delve into how you can use it to your advantage.

Over the long term, the index can help you identify periods of sustained fear or greed in the market. These extended periods can often signal major market tops or bottoms. For instance, a prolonged period of Extreme Greed could indicate a bubble that’s about to burst, while a sustained period of Extreme Fear might signal a market that’s oversold and ripe for a rebound.

By observing the index over time, you can also get a sense of the market’s cyclical nature. Crypto markets, like all markets, go through cycles of boom and bust. These can be driven by various factors, such as the Bitcoin halving events, technological advancements, regulatory changes, or broader macroeconomic factors. By keeping an eye on the Fear and Greed Index, you can get a sense of where we might be in these cycles.

However, remember that the index should not be used in isolation. It’s a sentiment indicator, and while sentiment can drive markets in the short term, long-term price movements are typically driven by fundamentals. Therefore, it’s important to combine the index with fundamental analysis and other technical indicators for a comprehensive view of the market.

The Crypto Fear and Greed Index: A Valuable Addition to Your Crypto Trading Arsenal

In the unpredictable and fast-paced world of cryptocurrency trading, having as much information as possible is key to making informed decisions. This is where the Crypto Fear and Greed Index comes in. By providing an insight into market sentiment, it helps traders understand the emotional state of the market, which can often drive price movements.

The index is particularly useful in crypto trading, where volatility is the name of the game. In such a market, sentiment can swing wildly from one extreme to another in a very short time with so much FUD and FOMO around. By keeping a close eye on the index, traders can stay one step ahead and make decisions that align with the market’s mood.

Moreover, the index is incredibly user-friendly. It distills a range of complex data into a single, easy-to-understand number. This means that even if you’re new to crypto trading, you can use the index to help guide your decisions.

However, as we’ve mentioned before, the Crypto Fear and Greed Index is just one tool. Successful trading requires a well-rounded approach, combining sentiment analysis with technical and fundamental analysis. Think of the index as a valuable addition to your arsenal, helping you navigate the emotional roller coaster that is the crypto market.