Blockchain technology, the backbone of the cryptocurrency world, has been hailed as a revolutionary force, promising transparency, security, and decentralization. However, the second quarter (Q2) of 2023 unveiled a darker side of this digital frontier; in the realm of decentralized finance (DeFi), a sector that leverages blockchain technology to recreate and improve upon traditional financial systems, a shocking $204 million was lost due to scams and hacks.

This startling revelation, brought to light by a report from De.Fi, a Web3 portfolio app, underscores the inherent risks and vulnerabilities that exist within the DeFi landscape. While blockchain technology offers the promise of a decentralized and autonomous financial future, it also presents a fertile ground for nefarious activities. The loss of over $200 million serves as a stark reminder that the path to financial autonomy is fraught with unseen dangers.

The Sobering Reality of DeFi’s Dark Side

The DeFi space, while innovative and promising, is not immune to the darker aspects of human nature. The “Q2 DeFi Cybercrime Report” by De.Fi paints a sobering picture of the challenges faced by the DeFi community. The report serves as a reality check, highlighting the fact that the freedom and autonomy offered by DeFi also come with significant risks.

The DeFi landscape, much like the Wild West, is a territory of uncharted opportunities and dangers. The absence of centralized control, while liberating, also means there’s less oversight and regulation. This environment can be exploited by malicious actors who seek to defraud unsuspecting users. The second quarter of 2023 alone saw a staggering $204 million lost to scams and hacks, a figure that underscores the urgent need for increased security measures and user education.

The Anatomy of DeFi Scams and Hacks

Understanding the nature of DeFi scams and hacks is the first step towards prevention. These malicious activities can take various forms:

- Rug Pulls: This is a type of scam where the developers behind a DeFi project abruptly abscond with the funds raised, leaving investors with worthless tokens. This is akin to pulling the rug out from under someone’s feet, hence the name.

- Flash Loan Attacks: In this type of attack, a malicious actor takes advantage of the uncollateralized loan feature in DeFi platforms to manipulate the market. They borrow a large amount of tokens, use them to manipulate the market, and then pay back the loan, all within a single blockchain transaction.

- Phishing Attacks: This is a form of fraud where scammers trick users into revealing their private keys or other sensitive information. Once the scammers have this information, they can gain access to the users’ wallets and steal their funds.

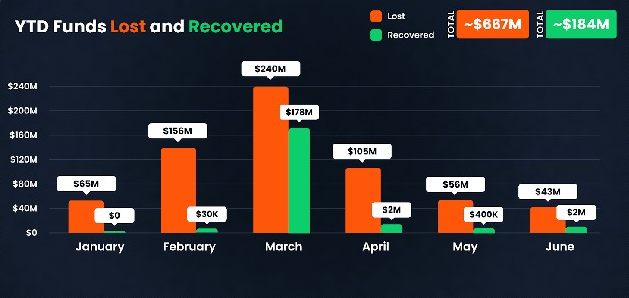

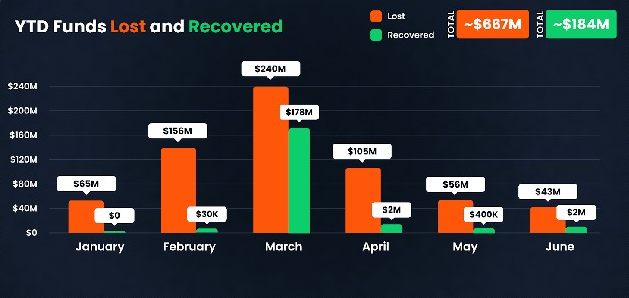

The Staggering Figures

The numbers presented in the “Q2 DeFi Cybercrime Report” by De.Fi are nothing short of staggering. The report revealed that an initial loss of $208.5 million was incurred due to DeFi scams and hacks. This figure alone is enough to give anyone pause. However, through swift and coordinated recovery efforts, approximately $4.5 million was reclaimed. Despite these efforts, a mind-boggling $204 million remains lost in the digital ether.

These figures serve as a stark reminder of the potential risks lurking in the DeFi space. They underscore the fact that while the world of decentralized finance offers immense potential for financial freedom and autonomy, it also harbors significant risks that users must be aware of and prepared for.

Addressing the Elephant in the Room

The steep monetary loss is a concerning trend that needs to be addressed head-on. The DeFi community and stakeholders can adopt several measures to mitigate these risks:

- Education: Knowledge is power. Raising awareness about the common types of scams and how to avoid them can go a long way in preventing future losses. This includes educating users about safe practices, such as not sharing private keys and being cautious of too-good-to-be-true investment opportunities.

- Security Audits: Regular audits of DeFi projects can help identify and fix security vulnerabilities before they can be exploited. These audits should be conducted by reputable third-party firms to ensure impartiality and thoroughness.

- Insurance: DeFi insurance can provide a financial safety net for users in case of hacks or scams. While it may not prevent scams or hacks from occurring, it can provide users with some level of financial protection should they fall victim to such incidents.

Looking Ahead

As we venture deeper into the universe of decentralized finance, it’s crucial to remember that with great power comes great responsibility. The freedom and autonomy that DeFi offers also come with the necessity for users to be vigilant about their own security. The recent $204 million loss serves as a harsh lesson, but one that can guide future actions and decisions.

In the face of these challenges, the DeFi community must strive to create a safer environment for its users. This can be achieved through continuous education, regular security audits, and the provision of insurance options. While the path may be fraught with difficulties, the potential rewards make the journey worthwhile.

DeFi presents a unique opportunity to democratize finance and give power back to the people. It’s a vision worth fighting for, and with the right measures in place, we can mitigate the risks and maximize the benefits that this revolutionary technology offers.