Cryptocurrencies and blockchain technology have taken the world by storm, reshaping the way we think about money and financial systems. These groundbreaking innovations have unlocked new investment opportunities and allowed for the creation of decentralized applications (dApps) with endless possibilities. At the core of this digital asset ecosystem are cryptocurrency exchanges, the platforms that enable individuals to buy, sell, and trade various cryptocurrencies. These exchanges come in two primary forms: centralized exchanges (CEX) and decentralized exchanges (DEX). In this comprehensive guide, we’ll focus on centralized crypto exchanges, exploring their role in the blockchain landscape, their advantages and disadvantages, and what you need to know to make informed decisions as a crypto enthusiast.

What is a Centralized Crypto Exchange (CEX)?

A centralized crypto exchange (CEX) is a privately owned and operated platform that facilitates the trading of cryptocurrencies by connecting buyers and sellers. CEXs act as intermediaries, providing the infrastructure and services necessary for users to trade crypto assets seamlessly. When you sign up for a CEX, you create an account and deposit your funds, whether in fiat currency (like USD or EUR) or cryptocurrencies (like Bitcoin or Ethereum).

In a CEX, transactions occur between users, with the exchange matching buy and sell orders from its customer base. The platform maintains an order book, a record of all open buy and sell orders, and uses specialized algorithms to match corresponding orders. Once orders are matched, the exchange serves as a clearing counterparty, ensuring that the transaction is completed and both parties fulfill their obligations. In this process, the CEX provides anonymity, as buyers and sellers do not directly interact with one another.

Additionally, centralized exchanges act as custodians for users’ funds. When you deposit money or crypto into your account, you’re entrusting the exchange to keep your assets safe, similar to how you would trust a bank to protect your deposits. CEXs implement various security measures, such as two-factor authentication (2FA) and cold storage, to safeguard users’ funds and personal information.

Some popular centralized exchanges include Binance, Coinbase, Bybit, Gemini, Kraken, and Kucoin. These platforms vary in terms of features, fees, and supported cryptocurrencies, so it’s essential to understand their differences when choosing the right CEX for your needs.

Advantages of Centralized Crypto Exchanges

Centralized crypto exchanges offer several benefits that make them attractive to many users, particularly those new to the world of cryptocurrencies.

- Ease of use and accessibility: CEXs are designed with user-friendliness in mind, providing intuitive interfaces and straightforward account creation processes. This makes them an ideal starting point for beginners who may find decentralized exchanges more challenging to navigate.

- High liquidity and trading volume: Centralized exchanges typically boast higher liquidity and trading volumes than their decentralized counterparts. This allows users to execute trades quickly and efficiently, reducing the risk of slippage (price changes during the execution of an order).

- Advanced trading features and options: Many CEXs offer a range of advanced trading options, including margin trading, futures contracts, and leveraged trading. These features can help experienced traders maximize their profits and manage risk more effectively.

- Customer support and regulatory compliance: Centralized exchanges often provide dedicated customer support services to assist users with any issues they may encounter. Additionally, many CEXs are subject to regulatory oversight, adhering to strict security and compliance standards. This can give users peace of mind, knowing that their assets and personal information are protected.

Disadvantages of Centralized Crypto Exchanges

Despite their many advantages, centralized crypto exchanges also have some downsides that users should be aware of:

- Central point of failure and hacking risk: As centralized platforms, CEXs can be vulnerable to cyberattacks. Over the years, there have been several high-profile hacks resulting in the loss of millions of dollars’ worth of user funds. While exchanges have improved their security measures, the risk remains.

- Privacy and data concerns: Centralized exchanges often require users to provide personal information and undergo identity verification processes (KYC). This can raise privacy concerns for some users, as their data is held by a third party and could be mishandled or misused.

- Potential for market manipulation and wash trading: Centralized platforms can be susceptible to market manipulation and wash trading, practices where bad actors artificially inflate trading volumes or manipulate asset prices. While many reputable CEXs take steps to combat these issues, the risks cannot be entirely eliminated.

- Dependency on platform performance and stability: When using a CEX, users rely on the platform’s performance and stability. If the exchange experiences technical issues or downtime, users may be unable to access their accounts, execute trades, or withdraw funds.

A List of Popular Centralized Crypto Exchanges

In this section, we’ll explore some of the most popular centralized crypto exchanges in the market, highlighting their unique features and security measures.

Coinbase

Coinbase is one of the most well-known and widely-used centralized crypto exchanges. It’s particularly popular among beginners due to its user-friendly interface and easy onboarding process. With support for a wide range of cryptocurrencies, users can buy, sell, and trade their favorite digital assets with ease.

Security is a top priority for Coinbase. The platform stores the majority of users’ funds in offline cold storage to minimize hacking risks. Additionally, the exchange offers two-factor authentication (2FA) to protect user accounts and complies with strict regulatory standards, making it a trusted choice for many.

Binance

Binance is a leading centralized exchange known for its extensive selection of cryptocurrencies, low trading fees, and advanced trading features. With options for margin trading, futures contracts, and staking, Binance caters to both novice and experienced traders.

In terms of security, Binance uses multi-tier and multi-cluster system architecture to protect its platform. It also employs two-factor authentication and monitors user activity for any suspicious behavior. While Binance has experienced a security breach in the past, the exchange has since improved its security measures and continues to be a popular choice for many users.

Kraken

Kraken is another reputable centralized crypto exchange that offers a wide range of cryptocurrencies and advanced trading features. It’s known for its robust security measures, including cold storage for the majority of user funds, 2FA, and strict regulatory compliance.

Kraken also provides users with a comprehensive range of trading options, including spot trading, margin trading, and futures contracts. Its user-friendly interface and responsive customer support make it an attractive option for both beginners and experienced traders alike.

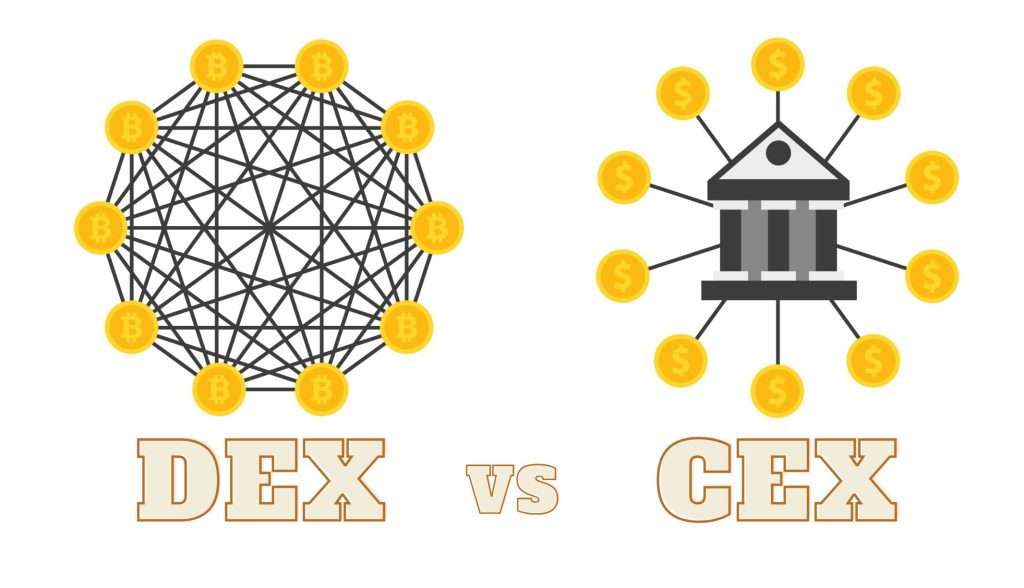

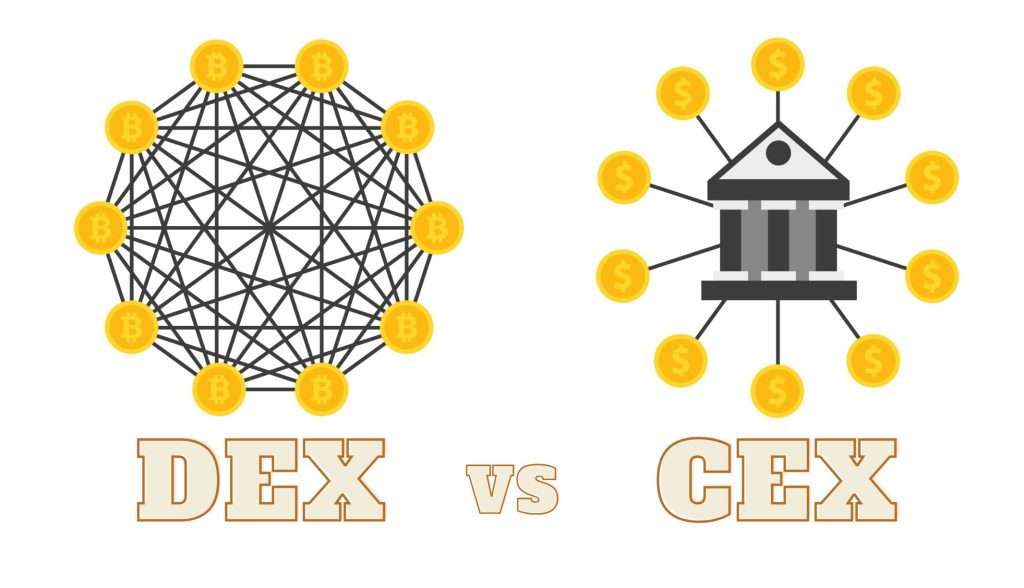

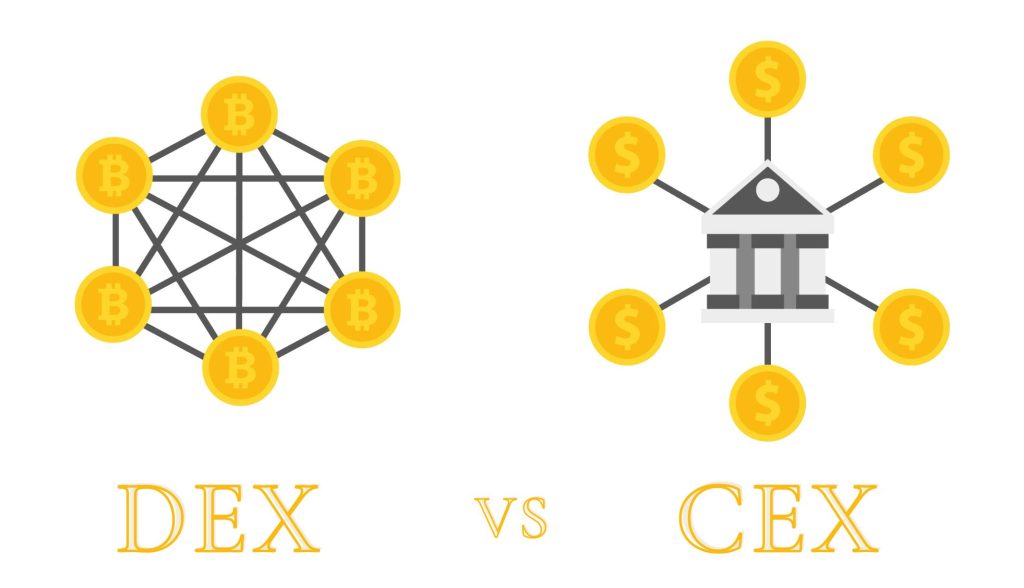

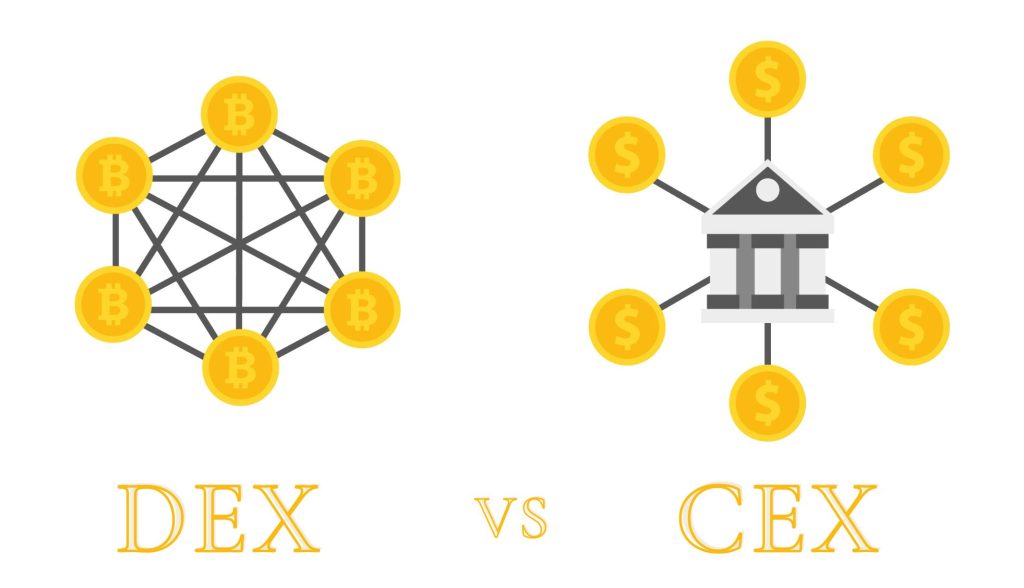

Centralized vs. Decentralized Exchanges: Key Differences

To better understand the differences between centralized and decentralized exchanges, let’s compare their features in a comparison table:

| Feature | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

|---|---|---|

| Control and Governance | Owned and operated by private companies, centralized governance. | No central authority, governed by smart contracts. |

| Custody of Funds | Users’ funds are stored and managed by the exchange. | Users maintain control of their funds in personal wallets. |

| Anonymity and Privacy | Require user identification (KYC) and have access to user data. | Often allow for anonymous trading without KYC. |

| Trading Volume and Liquidity | Typically have high trading volume and liquidity. | Lower trading volume and liquidity compared to CEXs. |

| Security Risks | Central point of failure, susceptible to hacking. | Lower risk of hacking due to decentralized nature. |

Centralized Exchanges (CEX)

- Operated by private companies with centralized governance.

- Exchange holds custody of users’ funds.

- Require user identification (KYC) and have access to user data.

- Typically have high trading volume and liquidity.

- Central point of failure, susceptible to hacking.

Decentralized Exchanges (DEX)

- No central authority, governed by smart contracts.

- Users maintain control of their funds in personal wallets.

- Often allow for anonymous trading without KYC.

- Lower trading volume and liquidity compared to CEXs.

- Lower risk of hacking due to decentralized nature.

Understanding the key differences between centralized and decentralized exchanges can help you make an informed decision when choosing the right platform for your needs.

Choosing the Right Exchange for You

Choosing the right exchange for your needs is a personal decision that depends on several factors. Here are some tips to help you find the best fit:

- Identify your priorities: Determine whether you value ease of use, privacy, security, or advanced trading features. This will help you narrow down your options.

- Evaluate fees: Exchanges charge various fees, including trading, deposit, and withdrawal fees. Compare fees across different platforms to find one that aligns with your budget.

- Consider security and regulatory compliance: Look for exchanges with strong security measures and a good track record. Ensure they follow relevant regulations to protect your funds and personal information.

- Assess available assets: Different exchanges support different cryptocurrencies. Make sure the platform you choose offers the assets you’re interested in trading.

- Research customer support: A responsive customer support team can be invaluable when you encounter issues or have questions. Read reviews and test their responsiveness before committing to an exchange.

- Weigh the pros and cons of CEX vs. DEX: Consider your risk tolerance, privacy preferences, and desired level of control over your funds. This will help you determine whether a centralized or decentralized exchange is better suited to your needs.

Bottom Line

Centralized crypto exchanges play a crucial role in the digital asset ecosystem. They offer numerous advantages, such as ease of use, high liquidity, and advanced trading features. However, they also come with potential risks, including security vulnerabilities and privacy concerns.

Understanding the differences between centralized and decentralized exchanges is vital for selecting the right platform for your needs. By evaluating your priorities, fees, security, supported assets, and customer support, you can make an informed decision that aligns with your unique preferences.

As the world of cryptocurrency exchanges continues to evolve, staying informed about new developments and advancements is key to maximizing your trading experience and safeguarding your digital assets.