Hey there, future crypto enthusiasts and mobile gamers! Have you ever wondered how your favorite digital currencies, like Bitcoin, come into existence? Well, you’re in luck! In this article, we’ll dive into the fascinating world of Bitcoin mining, a process that’s integral to the cryptocurrency ecosystem. We’ll explore the nitty-gritty details of mining, its profitability, and even its impact on the environment. So, buckle up and get ready for an enlightening ride through the world of virtual currencies.

What is Bitcoin Mining?

Imagine you’re a digital gold miner, working tirelessly to unearth precious digital treasures. That’s precisely what Bitcoin miners do! But instead of gold, these miners are after Bitcoins. Bitcoin mining is the process of creating new bitcoins while also maintaining the decentralized network’s security.

Miners essentially act as auditors, verifying the legitimacy of Bitcoin transactions to prevent double-spending, a sneaky way of spending the same digital coins twice. They bundle these transactions into ‘blocks,’ and by solving complex mathematical puzzles, they add these blocks to the ‘blockchain,’ a public, tamper-proof ledger of every transaction in the Bitcoin network.

Now, you might be thinking, “Why would someone go through all that trouble?” Well, there’s a pretty sweet incentive system in place. Miners receive newly created bitcoins as a reward for their hard work, not to mention transaction fees from the Bitcoin users. It’s a win-win situation for everyone involved – miners get paid, and the network remains secure and decentralized.

The Blockchain and Proof-of-Work: The Foundation of Bitcoin Mining

Let’s dive deeper into the heart of Bitcoin mining, shall we? To understand the ins and outs of mining, we first need to get a grip on two essential concepts: the blockchain technology and the Proof-of-Work (PoW) consensus algorithm.

The Blockchain and Proof-of-Work: Building Blocks of Bitcoin Mining

Blockchain technology is the backbone of the entire Bitcoin network. Think of it as a digital, public ledger that records every single transaction ever made using Bitcoin. It’s decentralized, which means no single entity controls it – a feature that makes it secure and resistant to tampering. The blockchain is made up of a series of ‘blocks’ that contain verified transactions, and these blocks are chained together in a linear, chronological order.

Now, how does the blockchain stay secure, you ask? That’s where the Proof-of-Work (PoW) consensus algorithm comes in. In a nutshell, PoW is a system that ensures that the process of adding a new block to the blockchain is challenging and requires considerable computational power. Miners must solve complex mathematical puzzles to add a new block, and the first one to crack the code is rewarded with newly created bitcoins. This process makes it extremely difficult for any bad actors to tamper with the blockchain, as they would need to control more than 50% of the network’s computing power – a near-impossible feat!

How a Block is Added to the Blockchain: A Real-Life Example

Now that we’ve covered the basics let’s walk through a real-life example of how a block is added to the blockchain. Imagine Alice wants to send some bitcoins to Bob. She initiates a transaction, which is then broadcasted to the entire network. Miners pick up this transaction, along with others, and start working on verifying them.

Miners must first ensure that the transactions are legitimate by checking the digital signatures and making sure that the users have enough bitcoins to complete the transaction. Once verified, they bundle these transactions into a new block.

Next, the miners compete to solve a complex mathematical puzzle related to the new block’s contents. This puzzle is a race against time, as the first miner to solve it gets to add the new block to the blockchain and reap the rewards. The winning miner broadcasts their solution to the network, and other miners verify it. Once the majority of the miners agree that the solution is valid, the new block is added to the blockchain, and the winning miner receives their reward in newly created bitcoins and transaction fees.

And just like that, Alice’s transaction to Bob is now a permanent part of the blockchain! The process then repeats itself as miners continue to validate transactions and add new blocks to the chain, ensuring the security and decentralization of the Bitcoin network.

Bitcoin Mining Hardware and Software: Tools of the Trade

To become a successful Bitcoin miner, you’ll need the right equipment and software. In this section, we’ll explore the evolution of mining hardware, popular software options, and key factors to consider when choosing the right mining setup.

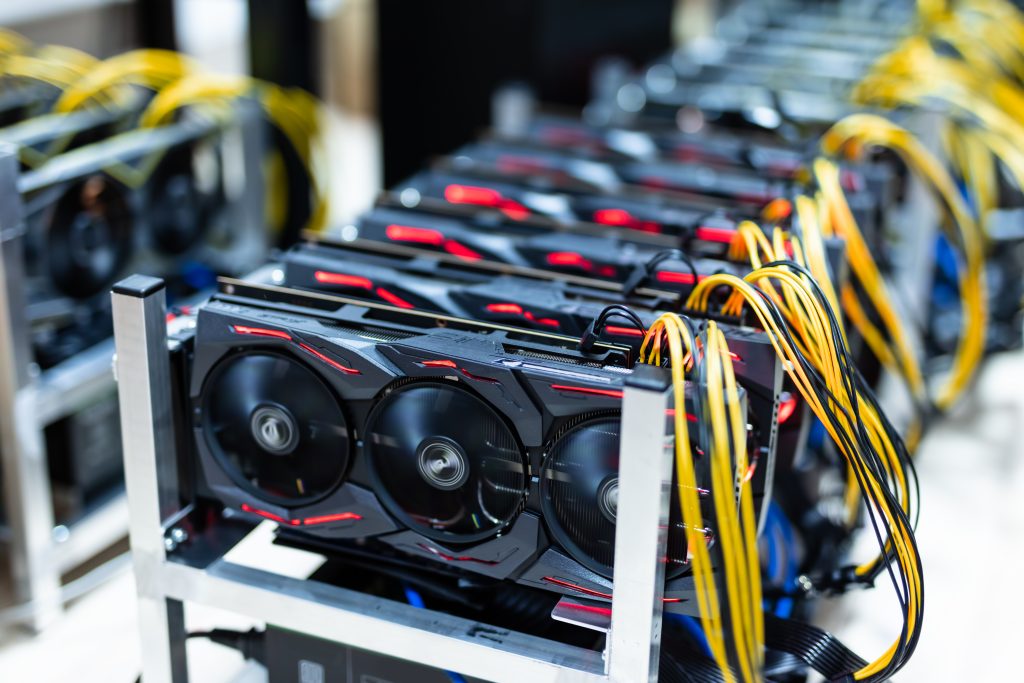

Evolution of Bitcoin Mining Hardware

Over the years, Bitcoin mining hardware has evolved significantly, with each generation becoming more powerful and efficient. Let’s take a look at this progression:

- CPUs: In the early days of Bitcoin, miners used their computer’s central processing unit (CPU) to mine. However, CPUs quickly became obsolete as they were relatively slow and consumed a lot of energy.

- GPUs: Miners soon discovered that graphics processing units (GPUs), commonly used for gaming, were much more efficient at mining than CPUs. GPUs increased the mining speed and used less energy, making them a popular choice for a while.

- ASICs: Application-specific integrated circuits (ASICs) changed the mining game completely. These specialized chips are designed explicitly for mining Bitcoin, making them incredibly efficient and powerful. Today, ASICs dominate the mining scene, leaving CPUs and GPUs far behind.

Popular Bitcoin Mining Software Options

Just as crucial as having the right hardware is choosing the right software to control your mining operations. There are several popular options available, each catering to different hardware configurations and user preferences. Some of the most widely-used mining software includes:

- CGMiner: A versatile, open-source mining software that works well with GPUs, ASICs, and FPGA devices. It’s compatible with Windows, Linux, and macOS, and offers advanced features like fan speed control and remote interface capabilities.

- BFGMiner: Similar to CGMiner, BFGMiner is also open-source and compatible with a wide range of devices. However, BFGMiner is primarily designed for ASIC miners and offers unique features like overclocking and mining with free Mesa/LLVM OpenCL.

- EasyMiner: A user-friendly option for beginners, EasyMiner offers a graphical interface that makes it easy to set up and manage your mining operations. It’s compatible with Windows and Linux and supports ASICs, GPUs, and CPUs.

Choosing the Right Mining Equipment: Key Factors to Consider

When selecting the best mining equipment for your needs, keep the following factors in mind:

- Efficiency: The more efficient your hardware, the more profitable your mining operations will be. ASICs are currently the most efficient option on the market.

- Cost: Consider your budget when purchasing mining hardware. While ASICs are the most efficient, they can also be quite expensive. GPUs are generally more affordable but may not be as profitable in the long run.

- Compatibility: Make sure the mining software you choose is compatible with your hardware. Some software options may only work with specific devices or operating systems.

- Electricity costs: Mining consumes a lot of energy, so be mindful of the electricity costs in your area. High electricity costs may offset potential mining profits.

By carefully considering these factors and weighing the pros and cons of each option, you can make an informed decision about the best mining setup for your needs.

Mining Pools vs. Solo Mining: Weighing the Options

As a Bitcoin miner, you can choose to join a mining pool or mine solo. Each option has its advantages and drawbacks, so let’s dive into the world of mining pools and solo mining to help you make an informed decision.

Introduction to Mining Pools

Mining pools are groups of miners who combine their computational power to increase their chances of earning Bitcoin rewards. By working together, they can solve blocks faster and more consistently than solo miners. The rewards are then split among the pool members according to the amount of work each miner contributed.

Pros and Cons of Joining a Mining Pool

| Pros | Cons |

|---|---|

| Increased chances of earning rewards | Pool fees reduce overall earnings |

| More consistent income stream | Less control over mining operations |

| Lower variance in mining rewards | Potential trust issues with pool operators |

Solo Mining: Is It Still Viable?

Solo mining means you’re mining by yourself, without joining a pool. While this option used to be more common in the early days of Bitcoin, it has become increasingly challenging due to the rising mining difficulty and competition.

However, solo mining can still be viable under certain circumstances, such as:

- You have access to low-cost electricity, which can reduce your operational costs.

- You possess a significant amount of high-quality mining hardware, allowing you to compete with larger mining operations.

- You value having full control over your mining operations and rewards.

It’s essential to consider the risks and potential rewards of solo mining carefully. If you have the necessary resources, solo mining can offer greater autonomy and potentially higher returns. However, you may also face longer periods without any mining rewards due to the increased competition and mining difficulty.

List of Popular Mining Pools: A Look at the Top Contenders

If you decide to join a mining pool, it’s crucial to choose a reputable and reliable one. Here’s a list of some popular mining pools to consider:

- F2Pool: One of the oldest and largest mining pools, F2Pool supports a variety of cryptocurrencies, including Bitcoin. Known for its stability and reliability, it charges a 2.5% fee for Bitcoin mining.

- Slush Pool: Established in 2010, Slush Pool is the first-ever Bitcoin mining pool. It has a user-friendly interface, making it suitable for beginners, and charges a 2% fee.

- Antpool: Operated by Bitmain, the leading manufacturer of ASIC mining hardware, Antpool is another popular choice among miners. It offers various payout options and charges a 1.5% fee for Bitcoin mining.

- BTC.com: A well-established mining pool, BTC.com has a transparent fee structure and user-friendly interface. It charges a 1.5% fee for Bitcoin mining.

- Poolin: A relatively new mining pool, Poolin has quickly gained popularity due to its advanced features and low fees. It charges a 1.5% fee for Bitcoin mining and supports various payout options.

Before joining any mining pool, it’s essential to research the pool’s reputation, fee structure, payout options, and other features to ensure it’s the right fit for your mining operations.

The Environmental Impact of Bitcoin Mining: A Growing Concern

Bitcoin mining, while essential for the cryptocurrency’s network, has raised concerns about its environmental impact. The process is energy-intensive and contributes to the global carbon footprint. In this section, we’ll explore the environmental implications of Bitcoin mining and the efforts being made to reduce its impact.

Energy Consumption and Carbon Footprint

Bitcoin mining requires significant computational power, which in turn consumes vast amounts of electricity. As the mining difficulty increases, miners need more powerful hardware to keep up, resulting in even higher energy consumption. This energy usage not only raises concerns about sustainability but also contributes to greenhouse gas emissions and climate change.

It’s essential to understand that the carbon footprint of Bitcoin mining largely depends on the source of the electricity used. In regions where electricity is generated from fossil fuels, the environmental impact is more significant compared to areas where renewable energy sources are prevalent.

Efforts to Make Bitcoin Mining More Sustainable

Various initiatives aim to make Bitcoin mining more sustainable and eco-friendly. Some of the notable efforts include:

- Transitioning to renewable energy sources: Many mining operations are moving to regions with abundant renewable energy, such as hydroelectric power or solar energy. This shift helps reduce the carbon footprint of Bitcoin mining and makes the process more sustainable.

- Increasing energy efficiency: Improvements in mining hardware can lead to increased energy efficiency, reducing the overall electricity consumption. For example, the development of specialized ASICs has significantly improved the efficiency of mining compared to earlier technologies like CPUs and GPUs.

- Carbon offsetting: Some mining operations are investing in carbon offset projects to balance their environmental impact. By funding initiatives that reduce carbon emissions or promote sustainable practices, these miners aim to counteract the carbon footprint of their mining activities.

Eco-Friendly Mining Operations: Leading by Example

Several mining operations have made concerted efforts to prioritize sustainability and eco-friendly practices. Here are a few examples:

- Greenidge Generation: A New York-based mining operation, Greenidge Generation, repurposed a retired coal-fired power plant to run on natural gas. They also use excess energy from their power plant to mine Bitcoin, reducing waste and improving efficiency.

- Hive Blockchain Technologies: Hive Blockchain operates green mining facilities in Canada, Sweden, and Iceland, utilizing hydropower and geothermal energy sources. They are committed to maintaining a low carbon footprint and promoting sustainable practices within the industry.

- Enegix: Enegix, a Singapore-based mining company, is building a massive data center in Kazakhstan powered entirely by renewable energy. The facility will use wind and solar energy to power its mining operations, demonstrating a commitment to sustainable practices.

These examples show that it is possible for Bitcoin mining operations to prioritize environmental responsibility and sustainability. By adopting eco-friendly practices and investing in renewable energy sources, the industry can mitigate its environmental impact and contribute to a greener future.

Is Bitcoin Mining Profitable? Crunching the Numbers

Determining whether Bitcoin mining is profitable can be a complex task, as numerous factors influence its success. In this section, we’ll explore the factors that affect mining profitability and provide a step-by-step guide for calculating potential returns. We’ll also discuss the risks and challenges associated with Bitcoin mining and examine real-life case studies to understand the different outcomes miners can experience.

Factors Affecting Mining Profitability and How to Calculate It

Several factors can impact the profitability of Bitcoin mining, including:

- Hardware and electricity costs: The upfront investment required for mining equipment and the ongoing electricity expenses to run the hardware are significant factors affecting profitability.

- Mining difficulty: The Bitcoin network adjusts mining difficulty to maintain a steady rate of new bitcoins entering circulation. As more miners join the network, the difficulty increases, making it harder to earn rewards.

- Bitcoin’s market value: The price of Bitcoin can be highly volatile, and its value directly impacts mining profitability. If the price drops, miners may find it more challenging to recoup their investment and cover operational costs.

To calculate potential mining returns, you can use online mining calculators that take these factors into account. Here’s a step-by-step guide:

- Gather the necessary information, including your mining hardware’s hash rate, power consumption, and cost, along with your local electricity rate.

- Plug these values into a mining calculator, which will estimate your potential earnings based on current network difficulty and Bitcoin’s market value.

- Compare your estimated earnings to your total expenses (hardware and electricity) to determine if mining will be profitable in your specific situation.

Risks and Challenges of Bitcoin Mining

Bitcoin mining comes with its fair share of risks and challenges that miners should be aware of:

- Market fluctuations: The volatile nature of the cryptocurrency market can lead to unpredictable mining profitability. Miners need to be prepared for market downturns that could negatively impact their earnings.

- Regulatory changes: Governments worldwide are still figuring out how to regulate cryptocurrencies, and any changes to regulations could impact miners’ operations or profitability.

- Increased competition: As more miners enter the market, competition for mining rewards intensifies, leading to higher mining difficulty and reduced profitability.

- Hardware obsolescence: Technological advancements in mining equipment can quickly make older hardware obsolete, requiring miners to upgrade their equipment to remain competitive.

Profitability Case Studies: Real-Life Successes and Failures

Different miners have experienced varying levels of success in Bitcoin mining. Let’s look at a few examples:

- Success story – Genesis Mining: Founded in 2013, Genesis Mining has become one of the largest cloud mining providers in the world. They’ve managed to stay profitable by investing in efficient hardware, utilizing renewable energy sources, and offering competitive contracts to customers.

- Failure story – Giga Watt: Giga Watt, a U.S.-based mining company, filed for bankruptcy in 2018 after struggling with debt, declining cryptocurrency prices, and regulatory challenges. Their failure highlights the importance of managing costs and being prepared for unpredictable market conditions.

These case studies demonstrate that Bitcoin mining can be both profitable and risky. Miners need to carefully consider factors such as hardware costs, mining difficulty, and market volatility when deciding whether to enter the mining industry. By staying informed and making strategic decisions, miners can improve their chances of success in this competitive market.

Bottom Line

As we’ve explored in this article, Bitcoin mining plays a crucial role in the cryptocurrency ecosystem, maintaining the decentralized nature of the Bitcoin network and facilitating secure transactions. From understanding the basics of mining to the environmental impact and profitability factors, we’ve delved into various aspects of this fascinating industry.

If you’re considering entering the world of Bitcoin mining, it’s essential to carefully weigh the opportunities and challenges that come with it. Keep in mind that the market is highly competitive and ever-evolving, with technological advancements and regulatory changes continually shaping the landscape. As a potential miner, staying informed and adaptable will be key to your success.

For those simply interested in the world of cryptocurrency and blockchain technology, we hope this article has provided valuable insights into the complex and captivating process of Bitcoin mining. As the industry continues to grow and evolve, there’s no doubt that mining will remain an integral part of the global cryptocurrency network for years to come.