In the ever-evolving financial landscape, Bitcoin has emerged as a game-changer. This digital currency, or cryptocurrency, has taken the world by storm, sparking intense discussions and debates among investors, economists, and the general public alike. But the burning question that often arises is, “Why does Bitcoin have value?”

This question is not as straightforward as it might seem, as Bitcoin’s value is influenced by a complex interplay of various factors. This article aims to demystify these factors, delve into the intrinsic value of Bitcoin, and explore how it stands in comparison to traditional currencies.

Understanding the Value of Traditional Currencies

Traditional currencies, such as the US dollar or the Euro, derive their value from the trust and confidence users place in the currency’s issuer, typically a country’s government. These currencies hold value because they are universally accepted as a medium of exchange. They exhibit key attributes that make them useful: scarcity, divisibility, acceptability, portability, durability, and resistance to counterfeiting.

However, the value of traditional currencies isn’t static. It’s influenced by a myriad of factors, including economic indicators, geopolitical events, and even market sentiment. For instance, inflation can erode the value of a currency, while economic growth can enhance it. Political stability, interest rates, and trade balances can also impact a currency’s value. Understanding these dynamics is crucial to comprehend the value proposition of Bitcoin and other cryptocurrencies.

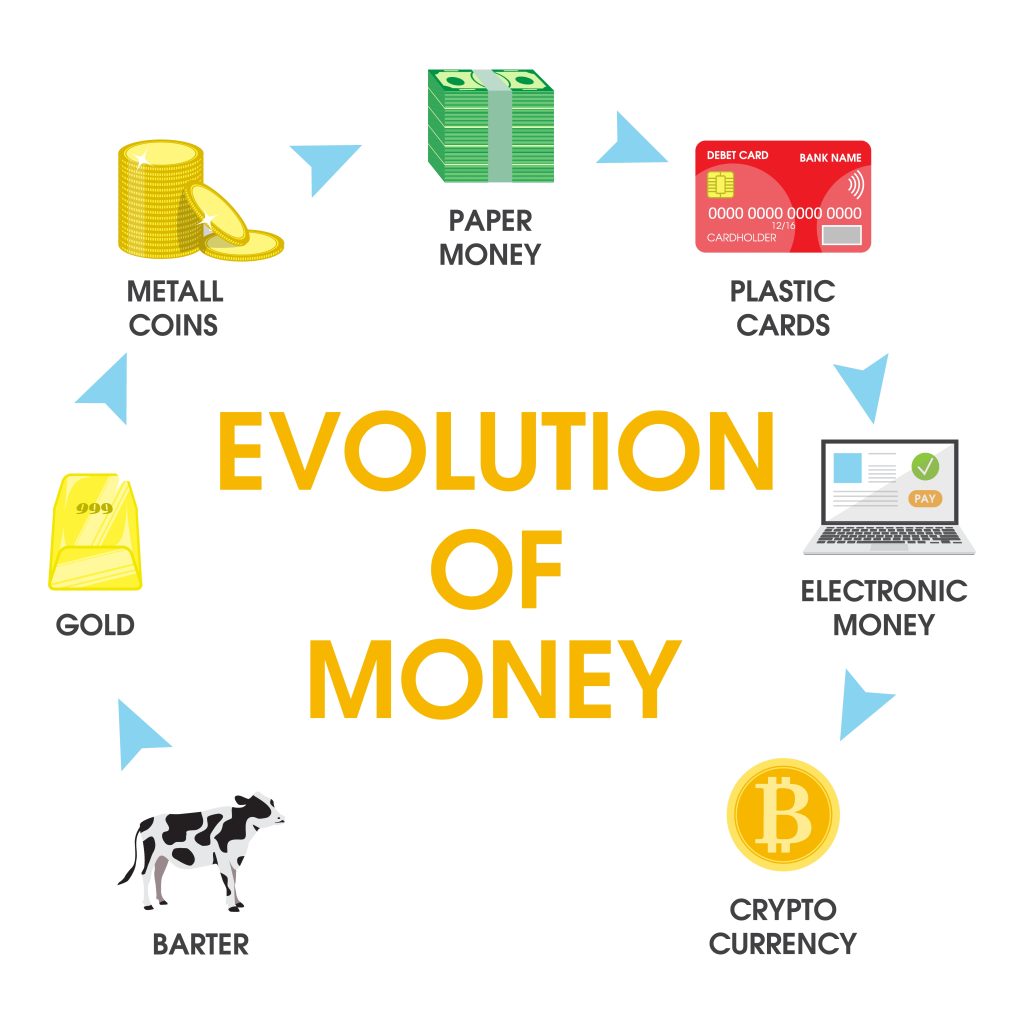

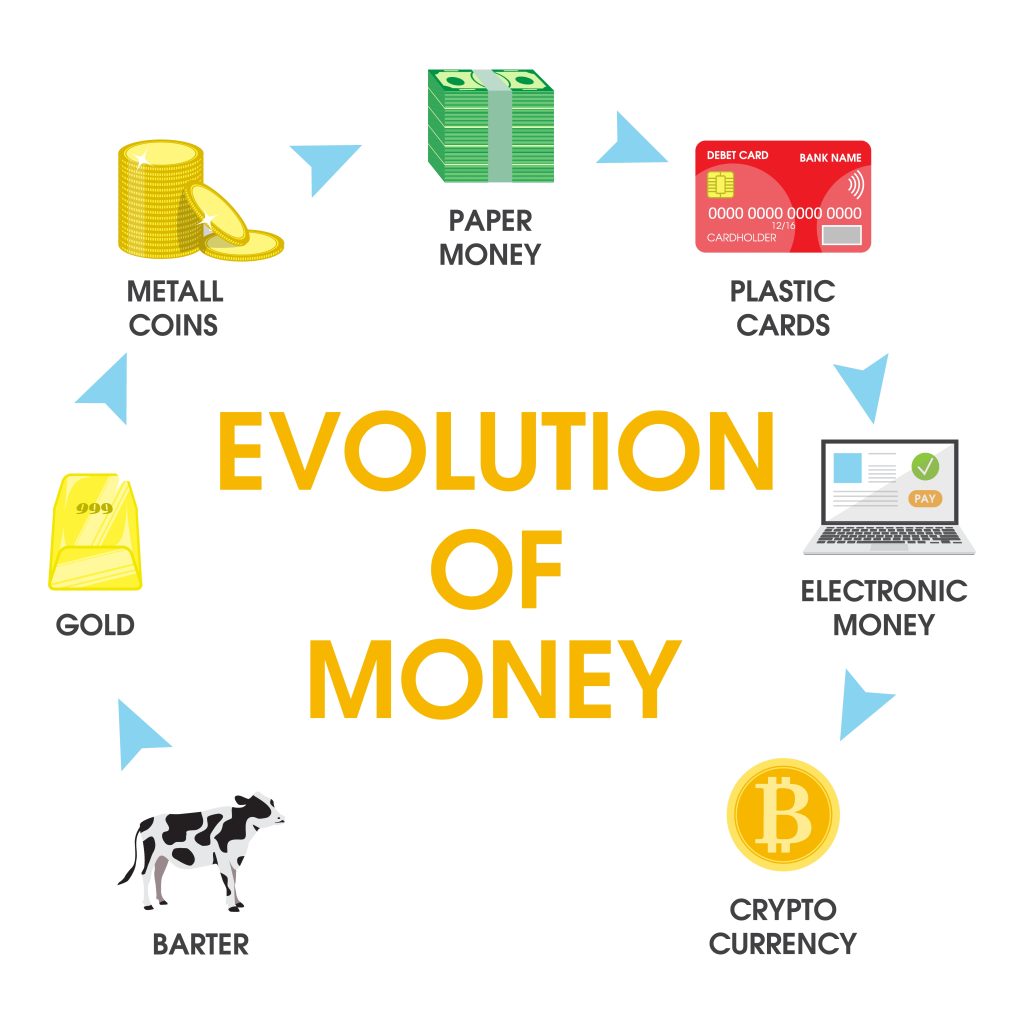

The Evolution of Money

Money has evolved significantly over the centuries. From commodities like gold and silver to paper money and digital currencies, each form of money has had its unique value proposition. The shift from physical to digital forms of money has been driven by the need for convenience and efficiency.

The idea of a currency’s value has also evolved over time. Initially, the value of a currency was tied to its intrinsic physical properties. For example, the value of gold was derived from its rarity and the difficulty involved in mining it. However, with the advent of paper money and digital currencies, the value of a currency has become more abstract, tied to factors like trust in the issuer and the stability of the underlying economy.

The Value of Digital Currencies

The advent of digital currencies has revolutionized the concept of money. Unlike traditional currencies, digital currencies like Bitcoin are not issued or regulated by any central authority. Instead, they operate on decentralized networks, making them immune to government interference or manipulation.

Digital currencies offer several advantages over traditional currencies. They can be transferred instantly across the globe without the need for intermediaries, making transactions faster and cheaper. They also provide a degree of anonymity, as transactions can be conducted without revealing personal information.

However, the value of digital currencies is highly volatile and can fluctuate wildly in a short period. This volatility is due to factors such as market demand, regulatory news, technological advancements, and macroeconomic trends.

Why Does Bitcoin Have Value?

Bitcoin, the first and most well-known digital currency, has value for several reasons. First, Bitcoin is scarce. The total supply of Bitcoin is capped at 21 million coins. This scarcity is hard-coded into the Bitcoin protocol and cannot be changed. This fixed supply makes Bitcoin resistant to inflation, a common issue with traditional currencies.

Second, Bitcoin is decentralized. It operates on a peer-to-peer network, where transactions are verified by network participants known as miners. This decentralization means that Bitcoin is not subject to government control or interference.

Third, Bitcoin is divisible and fungible. One Bitcoin can be divided into 100 million units, called satoshis. This divisibility makes Bitcoin suitable for micro-transactions, which are not possible with traditional currencies.

Finally, Bitcoin has value because people are willing to buy and trade it. The value of Bitcoin, like any other good or service, is determined by supply and demand. As more people adopt Bitcoin, its demand increases, which in turn increases its value.

The Scarcity of Bitcoin

One of the key factors contributing to Bitcoin’s value is its scarcity. The total supply of Bitcoin is capped at 21 million coins. This cap is enforced by the Bitcoin protocol and cannot be changed. This scarcity mirrors that of precious metals like gold, which also derive their value in part from their limited supply.

However, unlike gold, which can still be mined, the supply of Bitcoin is decreasing over time due to a process called halving. Every four years, the reward for mining new blocks is halved. This halving process will continue until the maximum supply of 21 million Bitcoins has been reached.

This decreasing supply and increasing demand for Bitcoin create a scarcity that drives up its value. As more people adopt Bitcoin, the demand for it increases, while the supply remains fixed. This scarcity is a key reason why Bitcoin has value.

The Cost of Producing Bitcoin

Bitcoin is created through a process known as mining. This involves using powerful computers to solve complex mathematical problems. When these problems are solved, new blocks are added to the Bitcoin blockchain, and the miners are rewarded with a certain amount of Bitcoin.

However, mining Bitcoin is not without its costs. It requires a significant amount of computational power and electricity. In fact, the Bitcoin network consumes more energy than some countries. These costs of production add to the intrinsic value of Bitcoin.

The cost of mining a single Bitcoin varies depending on the cost of electricity in the miner’s location and the efficiency of the mining equipment being used. As the Bitcoin network grows, the difficulty of the mathematical problems also increases, requiring more computational power and, therefore, more energy.

Monetarist Theories and Bitcoin

Monetarists, who focus on the role of money supply in an economy’s health, have also attempted to value Bitcoin. They use the supply of money, its velocity (the rate at which money is exchanged), and the value of goods produced in an economy.

For instance, if we consider the current worldwide value of all mediums of exchange and all stores of value comparable to Bitcoin, and then calculate Bitcoin’s projected percentage, we can estimate a potential future value for Bitcoin.

Assuming that Bitcoin achieves a certain percentage of this valuation, its market capitalization would be a certain amount. With all 21 million Bitcoins in circulation, this would put the price of 1 Bitcoin at a certain value. However, this is a simplistic approach and doesn’t take into account many other factors that can influence Bitcoin’s value.

The Challenges of Valuing Bitcoin

Valuing Bitcoin is not an easy task. Unlike traditional currencies, which are backed by a government and regulated by a central bank, Bitcoin operates on a decentralized network called the blockchain. This means its value is not influenced by monetary policy or inflation rates.

Bitcoin’s value is highly volatile and can be influenced by a variety of factors, including market demand, investor sentiment, regulatory news, and macroeconomic trends. This volatility can make it difficult to determine a fair value for Bitcoin.

Furthermore, Bitcoin’s utility as a medium of exchange is still limited. While some businesses accept Bitcoin, it is far from universally accepted. This limits its utility and, therefore, its value.

Finally, while Bitcoin’s scarcity and decentralized nature can be seen as advantages, they also present challenges. The finite supply of Bitcoin could potentially lead to hoarding, which could limit its use as a medium of exchange. Similarly, the lack of a central authority could lead to instability and potential misuse.

Is Bitcoin Money?

While Bitcoin shares some characteristics with traditional forms of money, whether it can be classified as “money” is a matter of debate. Economists typically define money as a store of value, a medium of exchange, and a unit of account. Bitcoin certainly can be a store of value, often referred to as “digital gold”. It’s also used as a medium of exchange, with some businesses accepting Bitcoin for goods and services.

However, Bitcoin’s use as a unit of account is limited. Very few goods or services are priced in Bitcoin, and it’s not used for everyday transactions like a traditional currency. Furthermore, Bitcoin’s volatility makes it less stable than most traditional forms of money, which can hinder its acceptance and use.

Bitcoin and the Regulatory Landscape

The regulatory landscape for Bitcoin and other cryptocurrencies is complex and evolving. Different countries have different attitudes towards cryptocurrencies, ranging from outright bans to welcoming them with open arms.

In the U.S., the Securities and Exchange Commission (SEC) has been closely monitoring the cryptocurrency space. The SEC has indicated that it views many cryptocurrencies as securities, which would subject them to specific regulatory requirements. However, Bitcoin, given its decentralized nature, has been classified as a commodity by the Commodity Futures Trading Commission (CFTC).

Regulation can impact Bitcoin’s value. Positive regulatory news can increase demand for Bitcoin, driving up its price. Conversely, regulatory crackdowns or bans can decrease demand, leading to price drops. As such, the regulatory landscape is a key factor in Bitcoin’s value.

Conclusion

Understanding why Bitcoin has value involves delving into economics, technology, and even philosophy. Bitcoin’s value lies in its potential to be a decentralized, scarce, and efficient medium of exchange that is not controlled by any government or organization. Its digital nature and underlying blockchain technology also offer potential utility that extends beyond just a currency.

However, Bitcoin’s value is also influenced by external factors such as regulatory developments and market demand. Its volatility and limited use as a unit of account also present challenges to its widespread adoption.

Despite these challenges, Bitcoin has shown remarkable growth and resilience since its inception in 2009. As the world continues to digitize and evolve, the role and value of Bitcoin and other digital currencies in our economy are likely to become increasingly significant.